DPT 3 Due Date for FY 2022-23 is 31st July 2023. As per Companies (Acceptance of Deposits) Rules, 2014 DPT3 is to be filed 30 days from 1st May of that financial year that is 30th June of every financial year.

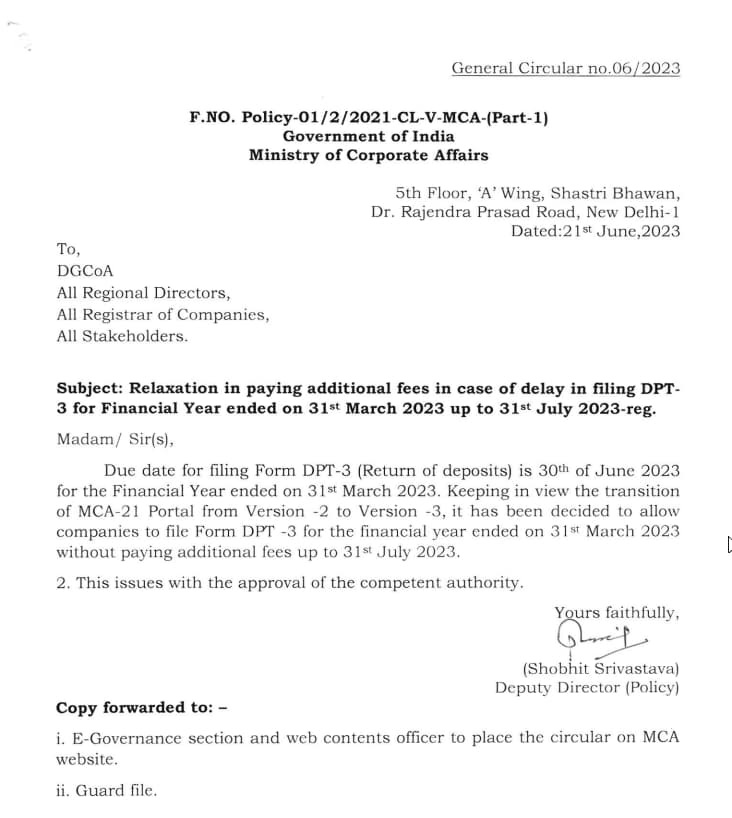

MCA released an official circular extending the DPT-3 due date from 30th June 2023 to 31st July 2023.

Table of Contents

DPT 3 Due Date

The due date for online filing of form dpt 3 is 30-06-2023 which is now extended to 31st July 2023.

Below are the details:

- One time Return for disclosure of details of outstanding money or loan received by a company but not considered as deposits in terms of rule 2(1)(c) of the Companies( Acceptance of Deposits) Rules, 2014- due date is Within 30 days from 1st May 2019.

- Return of deposits’ or ‘Particulars of transactions by a company not considered as deposit as per rule 2 (I) (c) of the Companies (Acceptance of Deposit) Rules, 2014’ Or ‘Return of Deposit and Particulars of transactions by a company not considered as a deposit.

DPT 3 Due Date for Annual Return

| Financial Year | DPT 3 Due Date |

| DPT 3 due date for FY 2018-19 | 30th June 2019 |

| DPT 3 due date for FY 2019-20 | 30th Sept 2020 |

| DPT 3 due date for FY 2020-21 | 31st August 2021 |

| DPT 3 due date for FY 2021-22 | 30th June 2022 |

| DPT 3 due date for FY 2022-23 | 31st July 2023 |

DPT 3 Extension for FY 2022-23

DPT-3 Due date extended to 31st July 2023 for FY 2022-23.

As per the latest official MCA circular 11/2021 dated 21st June 2023, MCA has extended due date to 31st July, 2023 due to the transition of MCA-2 1 Portal from Version -2 to Version -3.

MCA Circular on DPT-3

Extension for FY 2020-21

DPT-3 Due date extended to 31st August 2021 for FY 2020-21.

As per the latest official MCA circular 11/2021 dated 30th June 2021, MCA has extended due date to 31st August, 2021 for filing of forms by companies/LLPs under Companies Act 2013/ LLP Act 2008. Further, only normal fees will be applicable up to 31st August, 2021 for forms required to be filed between 1st April to 31st July, 2021.

DPT 3 Notification

Every company must file DPT 3 Annual Return or One Time Return annually. As per MCA DPT 3 Notification on 22nd Jan 2019, every company must file One Time Return for outstanding loans as of Mar 2019. Before this notification, only companies who accept deposits were to file deposits in eform DPT3 annually. However, as per the Companies (Acceptance of Deposits) Amendment Rules, 2019, Every company must file DPT 3 for outstanding loans annually. Accordingly, the due date to file DPT 3 Annual return is June 30th of every year. But, this year, due to the transition of MCA-21 Portal from Version -2 to Version -3, the MCA has provided relaxation to companies in paying additional fees in case of delay in filing DPT3. DPT 3 Form Last date is 31st July 2023. So, the companies need not pay any penalty if they file DPT 3 before 31st July 2023.

DPT 3 Rules MCA Extract

As per rule 16(A)Companies (Acceptance of Deposits) Rules, 2014, “Every company other than Government company shall file a onetime return of outstanding receipt of money or loan by a company but not considered as deposits, in terms of clause (c) of sub-rule 1 of rule 2 from the 01st April 2014 to the date of publication of this notification in the Official Gazette, as specified in DPT 3 Form within ninety days from the date of said publication of this notification along with fee as provided in the Companies (Registration Offices and Fees) Rules, 2014”.

Purpose of DPT 3 Annual Return / DPT 3 One Time Return

The Companies must disclose any Secured Loan and Unsecured Loan which is outstanding as of March 31st of the financial year. To file the DPT 3 Annual return, we will see in the below paragraphs the amounts that a company has to consider as Outstanding Loan and not Deposit. Companies that have only outstanding money/ Loan must file an Annual Return/One-time return.

DPT-3 Applicability

All Public, Private Limited companies and One Person Company meeting any of the below criteria must file form DPT-3.

- Onetime Return for disclosure of details of outstanding money or loan received by a company but not considered as deposits in terms of rule 2(1)(c) of the Companies (Acceptance of Deposits) Rules, 2014.

- Return of Deposit

- Particulars of transactions by a company not considered as deposit as per rule 2 (I) (c) of the Companies (Acceptance of Deposit) Rules, 2014.

- Return of Deposit and Particulars of transactions by a company not considered as deposit

Who is not required to file DPT 3 Form?

- A company that does not have any outstanding loan as of 22nd Jan 2019.

- A company that does not accept any loan.

- Government companies need not file DPT-3.

- A company that has already paid the loan before 22nd Jan 2019.

DPT-3 Annual Return / One Time Return

Amounts Received by Company considered as Outstanding Loan

(i) Amount Received from Central/ State Government

If the company receives any amount from the Central government or the state government during the financial year, the company must consider such amounts as outstanding loans and not deposits. Below are the different types of amount receipts (a)Any amount received from the Central Government or a State Government (b)Any amount received from any other source whose repayment is guaranteed by the Central Government or a State Government (c)Any amount received from a local authority (d)Any amount received from a statutory authority constituted under an Act of Parliament or a State Legislature.

(ii) Amount received from Foreign Governments

If a company receives any foreign amount, the company must consider such receipts as an outstanding loan. Listed below are the different types of foreign amounts

(a) Any amount received from foreign Governments.

(b) Any amount received from foreign or international banks, multilateral financial institutions.

(c) Any amount received from foreign Governments owned development financial institutions.

(d) Any amount received from foreign export credit agencies, foreign collaborators, foreign bodies, corporate and foreign citizens,

(e) Any amount received from foreign authorities or a person resident outside India subject to the provisions of the Foreign Exchange Management Act, 1999.

(iii) Amount Received from Bank

If a company receives an amount as a loan from the bank, the company must consider such amounts as an outstanding loan. Below is a list of different receipts from banks (a)Any amount received as a loan or facility from any banking company (b)Amount received from the State Bank of India or any of its subsidiary banks. (c)Amount received from a banking institution. (d)Amount received from a corresponding new bank. (e)Amount received from a co-operative bank.

(iv) Amount received from Public Financial Institutions

If a company receives a loan from Public Financial Institutions during the financial year, the company must consider such amounts as an outstanding loan. Below we shall see in detail the type of amounts received from Public Financial Institutions (a)Any amount received as a loan or financial assistance from Public Financial Institutions notified by the Central Government on this behalf in consultation with the Reserve Bank of India (b)Any amount received from regional financial institutions (c)Any amount received from Insurance Companies (d)Any amount received from Scheduled Banks.

(v) Amount received against the issue of commercial paper

Following are the different types of amounts that a company has to consider as an outstanding loan.

(a) Any amount received against the issue of commercial paper

(b) Any amount received against any other instruments issued under the guidelines or notification issued by the Reserve Bank of India.

(vi) Amount received from other company

If a company has received any amount from some other company in the financial year, such amounts are outstanding loans.

(vii) Amount received towards a subscription to any securities

If a company receives any amount towards share application money or other securities, such amounts are outstanding loans. Below are different types of amounts receipts for securities

(a)Any amount received towards a subscription to any securities inclusive of share application money. (b)Advance towards allotment of securities pending allotment

(viii) Amount received from the director of the Private company

A company may receive an amount from the company director, in which case such an amount is considered an outstanding loan. Therefore, the company must disclose such amounts in the board’s report. However, there is a condition for this amount to be considered an outstanding loan. The condition is that the director of the private company or relative of the director furnishes a declaration in writing that the amount is not given out of funds acquired by him by borrowing or accepting loans or deposits from others. Also, he has to furnish this declaration at the time of giving money to the company.

(ix) Amount raised by the issue of bonds or debentures

Any amount raised by the issue of bonds or debentures secured by a first charge or a charge ranking pari passu with the first charge on any assets referred to in Schedule III of the Act excluding intangible assets of the company or bonds or debentures compulsorily convertible into shares of the company within 6[Ten years]: Provided that if such bonds or debentures are secured by the charge of any assets referred to in Schedule III of the Act, excluding intangible assets, the amount of such bonds or debentures shall not exceed the market value of such assets as assessed by a registered valuer.

(x) Amount received from an employee of the company

If the company receives any amount from an employee of the company, it must satisfy the following conditions to consider it an outstanding amount. (a) The amount must not exceed his annual salary (b)Amount is like a non-interest bearing security deposit.

(xi) Non-interest bearing amount received & held in trust

If a company receives any non-interest bearing amount and holds it in the trust, it must consider such amounts as an outstanding loan.

(xii) Amount received as advance for the supply of goods and services

During business, a company receives different amounts in advance for the supply of goods and services. Below are certain conditions when a company must consider the amount as an outstanding loan.

Any amount received as advance for the business of the company

(a) The Supplier or Seller must appropriate the supply of goods or services against the supply of goods or provision of services within 365 days from the advance receipt date. (b) For the supply of goods or services must be appropriated against the supply of goods or provision of services concerning legal proceedings, the time limit of 365 days is not applicable. (c) In consideration for an immovable property under an agreement or arrangement is adjusted against such property. (d)As a security deposit for the performance of the contract for the supply of goods or provision of services. (e) For long-term projects for the supply of capital goods. (f) In consideration for providing future services in the form of a warranty or maintenance contract such that services do not exceed five years from the date of receipt of the amount. (g) as an advance received and as allowed by any sectoral regulator or following Central or State Government; (h)For subscription towards publication in print or in electronic mode to be adjusted against receipt of such publications.

(xiii) Amount brought in by the promoters of the company by way of an unsecured loan

Any amount brought in by the promoters of the company by way of an unsecured loan is subject to fulfilment of the following conditions, namely: (a) the loan is brought in pursuance of the stipulation imposed by the lending institutions on the promoters to contribute such finance; (b) the promoters or their relatives or both providing loan (c) the exemption under this sub-clause shall be available only till the loans of the financial institution or a bank are repaid and not after that;

(xiv) Amount accepted by a Nidhi company

If you are a Nidhi company whose core business is borrowing and lending money between its members, then any amount accepted by you is an outstanding loan. Now, you know what the amounts that a company has to consider as an outstanding loan are.

Checklist for DPT-3

1. Financial statements such as Balance Sheet and Profit and Loss Account to get the figures of Net Worth and Outstanding amount.

2. Auditor’s certificate- Not mandatory if you are filing DPT 3 to disclose outstanding loans. It is mandatory for only those companies which are filing DPT 3 to disclose the deposits held by it.

3. A Copy of trust deed – Mandatory if a company has a trust deed and details of same are mentioned in the form

4. Copy of instrument creating charge – Mandatory if the company has trust deed and details of same are mentioned in the form.

5. List of depositors – List of deposits matured, cheques issued but not yet cleared to be shown separately – Mandatory if the company has a balance of deposits outstanding at the end of the year.

6. Details of liquid assets in case of a company having deposits maturing before 31st March next year and following next year.

7.DSC of Director/ Manager/ CEO/ CFO/ Company Secretary to digitally sign the DPT 3 e-form.

We shall see a sample DPT 3 filed annually for FY 2019-20.

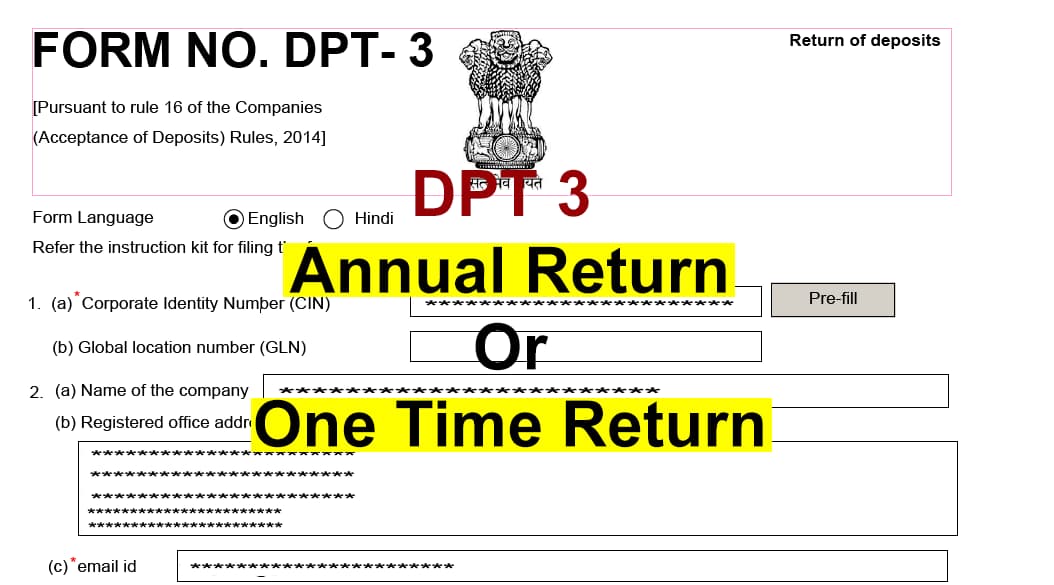

DPT 3 Form – Annual Return/ One Time Return

Earlier you can download the DPT3 form from the MCA website via DPT-3 download.

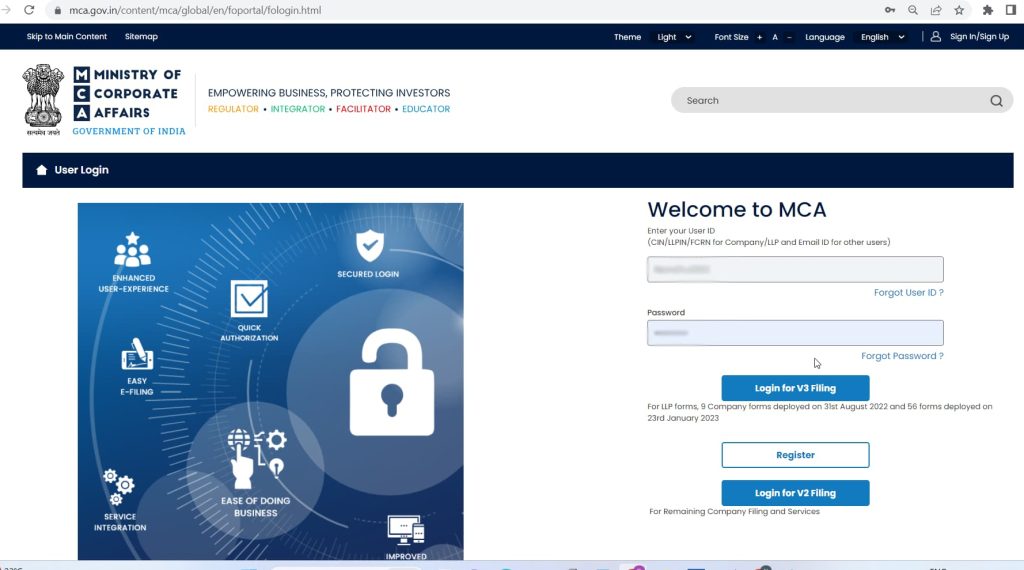

Now however, after MCA introduced the V3 portal, you must login to the MCA portal and efile the form DPT-3 on the portal.

Below are the steps to file form DPT-3:

- Go to the MCA portal https://www.mca.gov.in/content/mca/global/en/home.html

- Click on Sign in option at the top right corner.

- Enter your credentials and click on “Login for V3 Filing” to file form DPT-3.

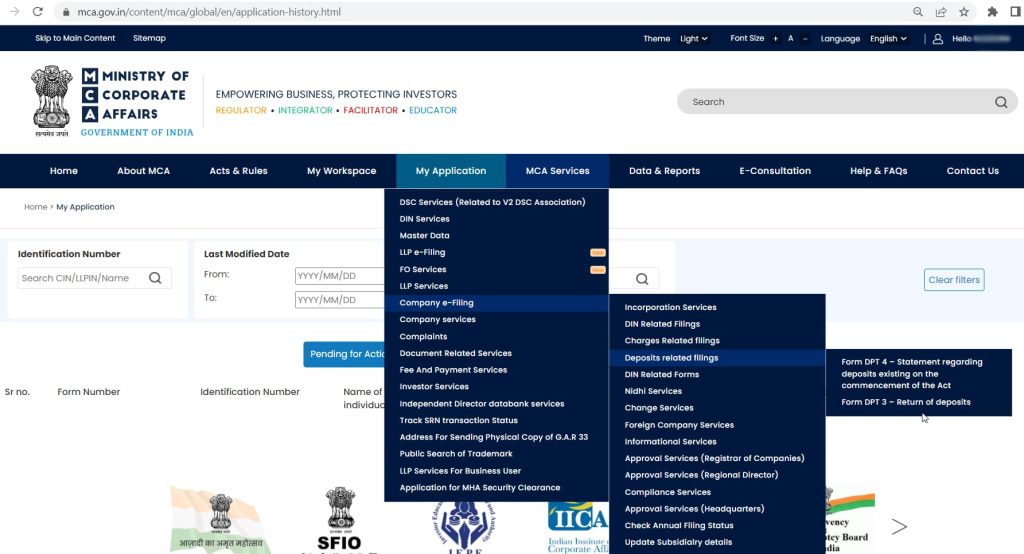

4. Navigate to MCA Services> Company e-filing> Deposits related Filings> Form DPT 3- Return of Deposits.

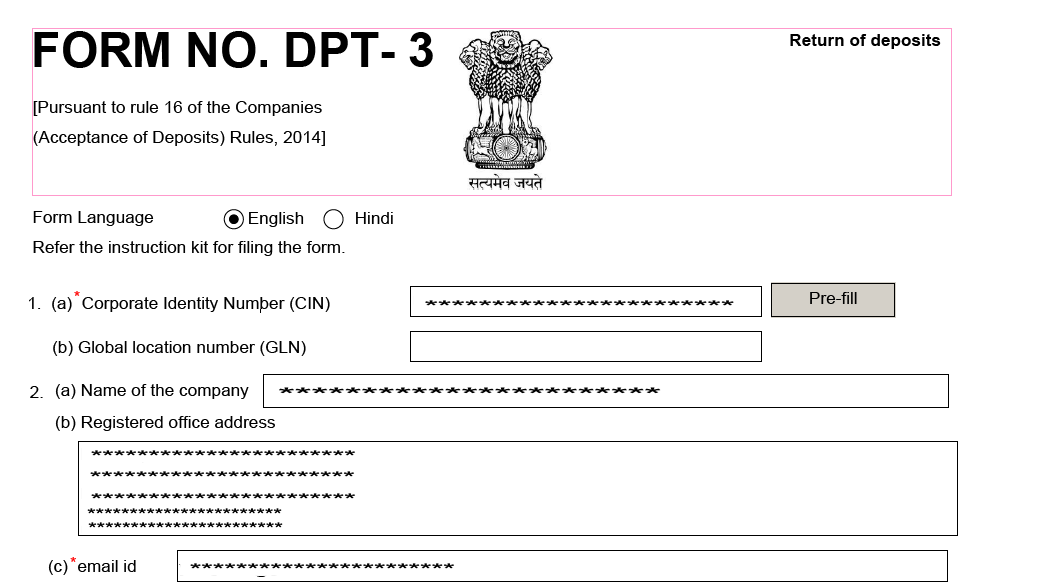

After navigating to the form DPT-3, you may follow the below steps on how to fill DPT 3 form.

(1) Firstly, enter the Valid CIN of the company. You may find CIN by entering the company’s existing registration number or name on the MCA website. (www.mca.gov.in )

(2) Click on Pre-fill to auto-populate the other details of the company.

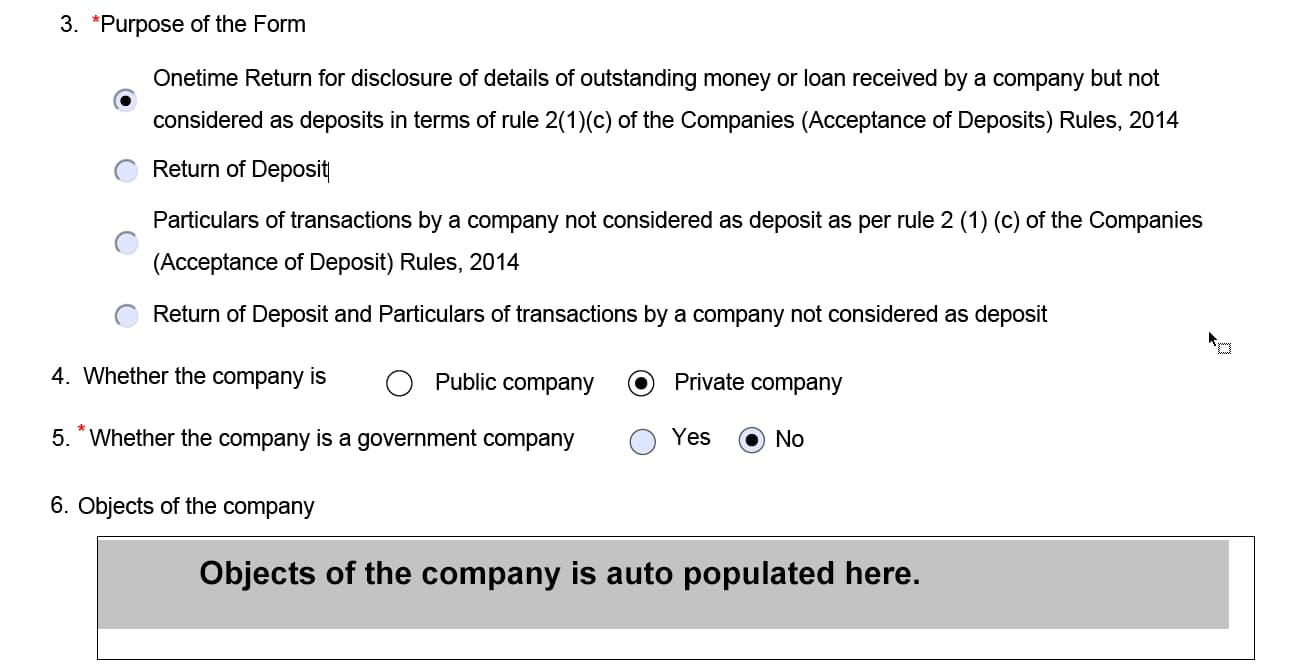

(3)(a)If you are filing DPT 3 Annual Return for an outstanding loan, click on the 3rd option- Particulars of transactions by a company not considered as deposit as per rule 2(1) (c). And disclose the outstanding loan to date.

OR

If you are filing the DPT 3 One Time Return, click on the 1st option, Onetime Return, as the purpose of the form and disclose the outstanding loan to date.

(4)Select the type of company as shown below.

(5)Confirm if you are a government company or not.

(6)The company’s Objects is auto-populated in the box as per the details given by you to ROC at the time of incorporating a company.

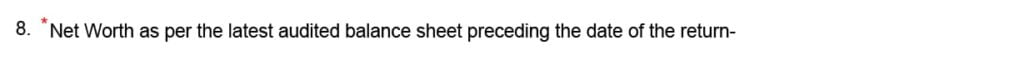

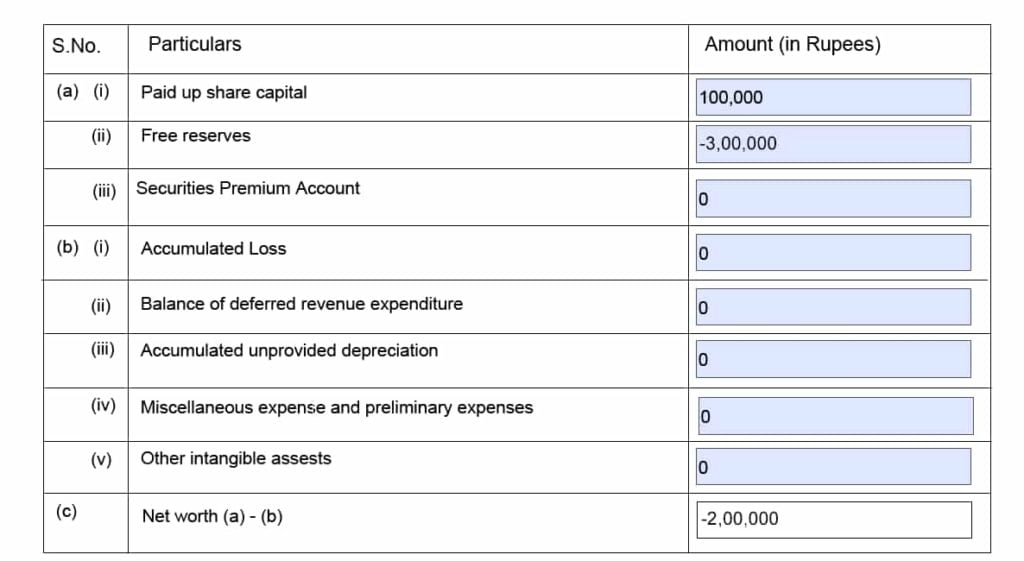

(8) Net worth of the company as of 31st Mar 2021 while filing DPT 3 for FY 2020-21.

DPT3 Net worth Calculation

You may provide the Net worth amount as per the latest audited balance sheet prior to the filing of DPT-3.

Let’s assume we are calculating the DPT3 net worth for FY 2021-22. If the latest audited balance sheet is for FY 2020-21 then you can consider the net worth amount of FY 2020-21.

However, to calculate the outstanding loan amount for FY 2021-22, you must consider the company’s outstanding amount as on 31st March 2022.

In the below eform, Fill in the fields that apply to your company. For example, we have taken Paid up share capital as 1,00,000 and Free reserves -3,00,0000 (Reserves & Surplus amount in balance sheet). Net worth=-2,00,0000

Note: Net worth & Free Reserves amount shows a negative figure because the company has taken a loan.

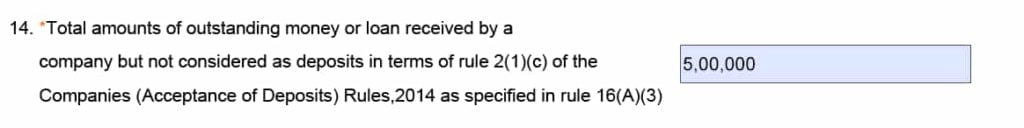

(14) Enter the total amount of secured and unsecured loans in this field

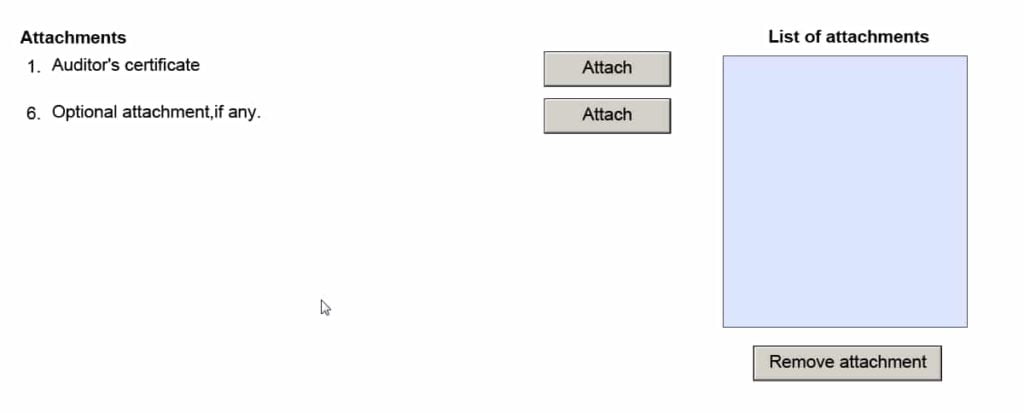

Attachments in DPT 3

It is not mandatory to attach Auditor’s report for a company having only an outstanding loan or money.

Declaration

(1) Mention the board resolution number and date of resolution authorising the person who can file DPT 3 on behalf of the company. [ See the sample Board Resolution for filing DPT 3 in the link]

Board Resolution for Filing DPT-3

(IN COMPANY LETTERHEAD)

EXTRACT OF THE RESOLUTION PASSED IN THE MEETING OF THE BOARD OF DIRECTORS OF ABC PRIVATE LIMITED HELD ON MONDAY, THE 20TH JULY 2021 AT 11.00 AM AT OFFICE OF THE COMPANY AT * (enter the address of the company)

BOARD RESOLUTION FOR FILING FORM DPT-3

“RESOLVED THAT approval of the Board be and is hereby accorded to severally authorise the (Designation of authorised person) to digitally sign and file the form DPT-3 as per the requirements of the Companies Act, 2013.

RESOLVED FURTHER THAT(enter authorised person name), (Designation of authorised person) of the company, be and is hereby authorised and shall always be deemed to have been authorised to undertake all such acts and deeds, including but not limited to the signing of Application, Forms, Resolutions, Deeds etc. in this regard and also issue of power of attorney in favour of any other person enabling such other person to appear before the various authorities under the aforesaid law in the matters of registration and the matters incidental thereto.”

CERTIFIED TRUE COPY

FOR ABC PRIVATE LIMITED

******************************

(Enter Director Name)

MANAGING DIRECTOR

******************************

(Enter Director Name)

WHOLE-TIME DIRECTOR

DATE: 19/11/2020

PLACE : *********

(2)Digitally sign the DPT 3 e-form. Director/ Manager/ CEO/ CFO/ Company Secretary can digitally sign this form.

(3)Update the DIN of Director/ PAN of manager/ CEO/ CFO/ Membership number of the company secretary.

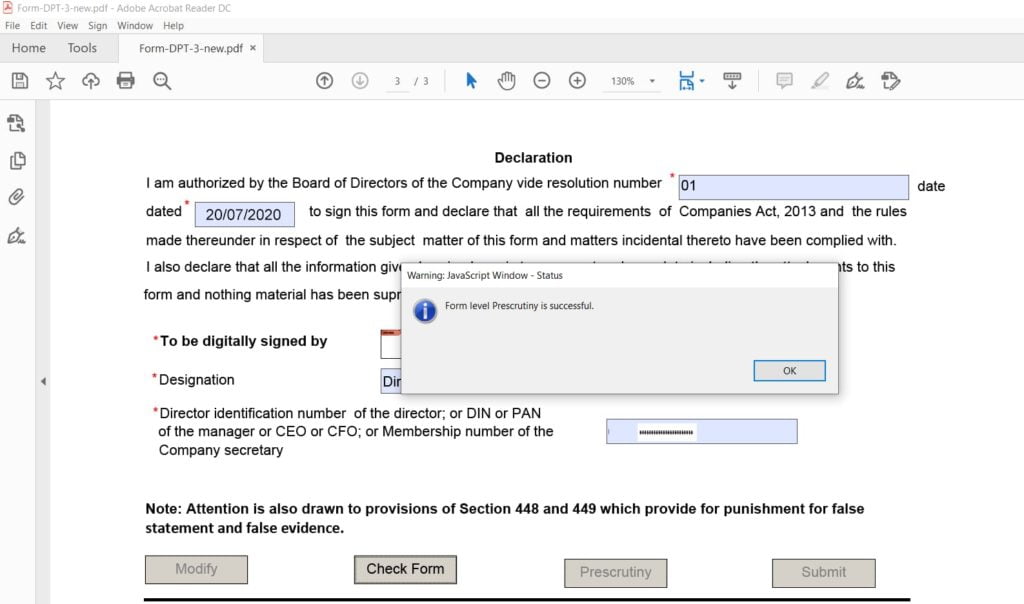

(4)Pre-scrutiny Click on Check Form. If any fields are incomplete in the form, it will show an error message. If you do not get any error messages, then click on Pre-scrutiny. You must get the message Pre-scrutiny Successful.

(5) Once Prescrutiny is successful, your eform is ready to upload.

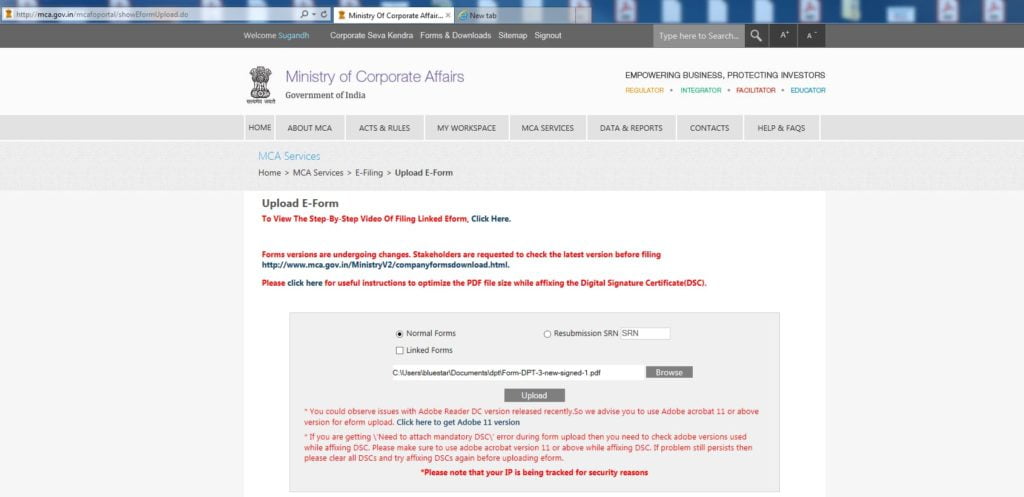

(6) DPT 3 E-Form MCA Upload

(1) Log in to the MCA website. Then Go to the E form upload and upload the eform.

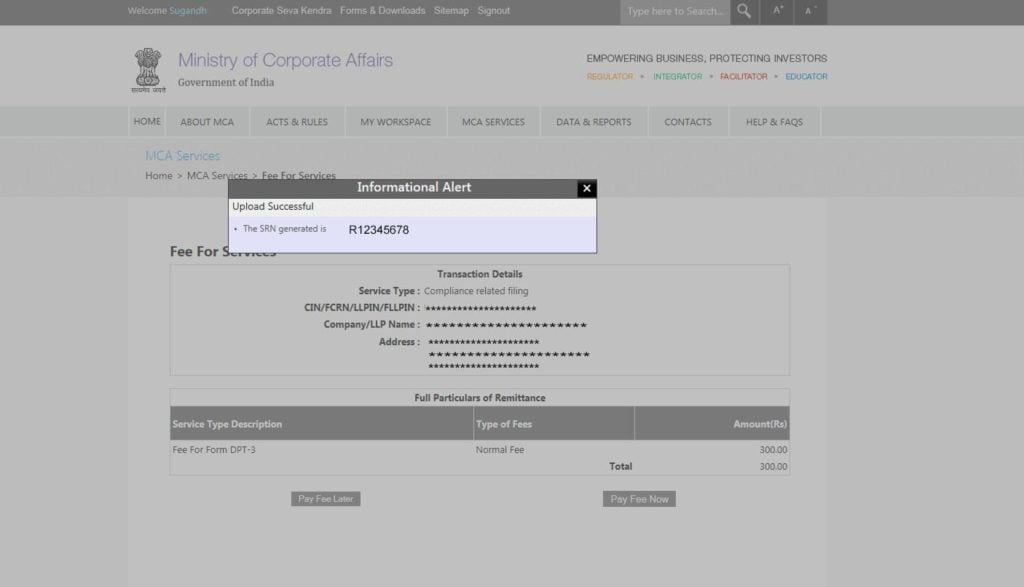

(2)SRN generation After uploading successfully, SRN generates. Take note of the SRN.

(3) Click on Pay later / Pay Now option to pay the government fees.

Tip: We suggest using the Pay Later option to retry payments if there is an error while paying the fees. Furthermore, we have noticed that usually, on the last date of filing, the online payment is not successful when we use the Pay Now option.

DPT 3 Return of Deposits

You can fill fields 1 to 6 similar to DPT 3 Annual Return for Outstanding loan. And fill the below fields only if the purpose is ‘Return of Deposit’ or ‘Return of Deposit and Particulars of transactions by a company not considered as a deposit’ is selected.

8. Maximum limit of deposits (i.e. 35% of the above in case of all companies other than specified IFSC public companies and private companies)-

Enter the maximum limit of deposit. This amount shall not be more than the maximum limit of deposits, i.e. 35% of the Net worth in all companies other than Private companies and IFSC public companies.

9(a). Total number of deposit holders as of 1st April-

Enter the total number of deposit holders as of 1st April. 9(b).The total number of deposit holders at the end of the financial year- Enter the total number of deposit holders at the end of the financial year.

10(a to e). Particulars of deposits (In Rupees)-

Enter the below details of deposits as applicable: (a) Amount of existing deposits as of 1st April (b) Amount of deposits renewed during the year (c) Amount of deposits accepted during the year (i) Secured deposits (ii) Unsecured deposits (d) Amount of deposits repaid during the year (e) Balance of deposits outstanding at the end of the year

12(a). Particulars of liquid assets:

Amount of deposits maturing before 31st March next year and following next year Enter the amount of deposits due for maturity in the next financial year and the year following the next year financial year.

12(b). The amount required to be invested in liquid assets-

Enter the amount that the company will be investing in liquid assets. This amount cannot be less than 15% of the sum of deposits maturing before 31st March next year and following next year, as mentioned in field 10(a).

12(c) Details of liquid assets-

Enter the details of liquid assets as at the end of the year in the table given.

13(a to d). Particulars of charge-

Enter the particulars of charge created for securing the deposits of the investors such as if applicable: (a) Date of entering into trust deed (b) Name of the trustee (c) Short particulars of the property on which charge is created for securing depositors (d) Value of the property

DPT 3 Filing Fees applicable in case of a company having a share capital

| Nominal Share Capital | Fee applicable |

| Less than 1,00,000 | Rupees 200 per document |

| 1,00,000 to 4,99,999 | Rupees 300 per document |

| 5,00,000 to 24,99,999 | Rupees 200 per document |

| 25,00,000 to 99,99,999 | Rupees 500 per document |

| 1,00,00,000 or more | Rupees 600 per document |

DPT 3 Filing Fees applicable in case of a company not having a share capital

Fee applicable- Rupees 200 per document

DPT 3 Late Fees

DPT 3 penalty for late filing is as follows:

| Period of delays | Late Fee for DPT 3 |

| Up to 30 days | Two times of normal fees |

| More than 30 days and up to 60 days | Four times of normal fees |

| More than 60 days and up to 90 days | Six times of normal fees |

| More than 90 days and up to 180 days | Ten times of normal fees |

| More than 180 days | Twelve times of normal fees |

DPT 3 FAQs

What is DPT 3 Form?

The DPT 3 Form Meaning- DPT 3 Form is a return of deposits or particulars of transaction not considered a deposit or both that every company must file before 30th June every year.

What is DPT-3 Return?

The DPT-3 Return is an annual return that every company with an outstanding loan as of 31st March of a financial year must file on or before 30th June of the following year.

What is the last date of DPT 3?

DPT3 last date 2023 is 31st July, 2023.

Is the DPT 3 date extended?

As per the MCA circular dated 21st June 2023, the dpt 3 due date for FY 2022-23 is extended. Due date for filing DPT-3 is 31st July 2023.

Is filing nil DPT 3 necessary?

If a company does not have any outstanding amount as of 31st March of the financial year, then it not necessary to file Nil return for DPT 3.

Is Auditor’s certificate mandatory for DPT-3?

If DPT 3 is filed for One Time return or Annual return for an Outstanding amount, it is not mandatory to attach the Auditor’s certificate. However, if the company is filing DPT 3 for Return of Deposit, then Auditor’s certification is required.

Is DPT3 applicable to NBFC?

No, NBFC companies need not file e-form DPT-3.

What is the purpose of DPT-3?

The DPT-3 is an eform used to file deposits or particulars of transactions not considered deposits or both by every company other than government companies.

Should Form DPT-3 be filed if there is no outstanding loan?

No, DPT-3 need not be filed if there is no outstanding loan at the end of the financial year.

How should I treat an amount received from a client/ customer in advance for goods or services?

Generally, the Seller must deliver the goods or services within 365 days from the advance receipt date. Otherwise, you must disclose the amount as an outstanding loan in DPT-3 unless you have a long term contract with the client.

Who should file form DPT-3?

All companies registered in India such as Private Limited Company, Public Limited Company, One Person Company (OPC) and Small Company must file DPT-3.

What date should I consider for showing the outstanding loan amount in DPT-3?

Any loans received from 1st April 2014 to 31st March 2023 and outstanding as of 31st Mar 2023 must be considered outstanding loans and shown in DPT-3.

If I receive any amount as a loan before 1st April 2014 and pay before 31st March 2023. Should I show this amount in DPT-3?

No, you must show only the amount outstanding as of 31st March 2023.

If I receive any amount as a loan before 1st April 2014 and is outstanding as of 31st March 2023. Should I show this amount in DPT-3?

Yes, the company must show any outstanding loan amount as of 31st March 2023.

If a company does not have any external deposits but has a loan from Director. Does it have to file DPT-3 form?

Yes, the company must furnish any outstanding loan from the Director as of 31st March 2023.

If I have an outstanding loan only this year, do I have to file DPT-3 twice- once for one-time declaration and one for regular or every year filing?

You can file DPT-3 only once. If this is the 1st time you are filing DPT-3, you can file a One Time Return for the current year. From next year onwards, if you have any outstanding loan, you can file DPT-3 annual return yearly by 30th June.

While filing DPT-3 for FY 2022-23 which financial year data is to be considered as the audit is not done for FY 2022-23?

For filing DPT-3 for FY 2022-23, you must consider the outstanding loan of the company as of 31st March 2023.

What is the due date for filing dpt-3 annual return 2023?

MCA has relaxed the timelines for filing of forms under the Companies Act 2013 and LLP Act 2008. Therefore, the due date for filing dpt-3 annual return 2023 is 31st July 2023.

What is the due date for filing dpt-3 annual return 2023?

The due date for filing dpt-3 annual return 2023 is 31st July 2023.

What to do if I keep getting the MCA portal error ” Your request could not be processed. There has been an internal application error”?

We suggest that you cancel the current SRN as you are unable to make the payment. Upload the eform DPT-3 again and generate a new SRN. Then, use the Pay Later option to make the payment. Even while using the Pay Later option, you may get an error. Cancel the previous SRN and Upload and try again until a e-challan is generated. After this point, even if you get any error, its okay. You can just go to the MCA Services>Fee and Payment Services>Pay Later. In the Pay Later Screen, enter your SRN and click on Pay.

Also, we suggest using the internet explorer for the purpose of uploading DPT-3 form and making payment.

Is there any helpdesk to reach out to for MCA queries?

For MCA payment related queries you may reach out to email id appl.helpdesk@mca.gov.in or call 0120 4832500.

While filing DPT-3 for FY 2020-21, which date shall be mentioned for closing of accounts and which FY data will be enclosed in point 15 by selecting option 3 of DPT-3 ? Because for FY 2020-21, audit is not done till date.

Madam, for FY 2020-21, in case of option3 in form DPT-3,

Date of last closing of accounts: 31-03-2021

Net Worth as per the LATEST audited balance sheet preceding the date of the return: 31-03-2020 i.e.,

–> we can give Net worth details of FY 2019-20 &

–> in all below columns we should mention any money or loan received by a company but not considered as deposits in the FY 2020-21

Regards

Irshad Ahmad

razack3294@gmail.com

31.03.2021

Whether NIDHI company is required to file dtp-3 annual return or not ?

All Companies registered under the Companies Act 2013, must file DPT-3 annual return except Government Companies. Since a Nidhi Company is incorporated under section 406 of the Companies Act 2013 it must comply with Public Limited Company Norms under Companies Act 2013 and Nidhi Rules 2014. In conclusion, a Nidhi Company should also file DPT-3.