TDS Return Due Date is useful for both Government and other Deductors. You can easily keep track of the TDS due dates and file TDS return on time. In this article we will discuss what is TDS, who should file TDS return, frequency of filing of TDS return, TDS Return Due Date and TDS rates applicable.

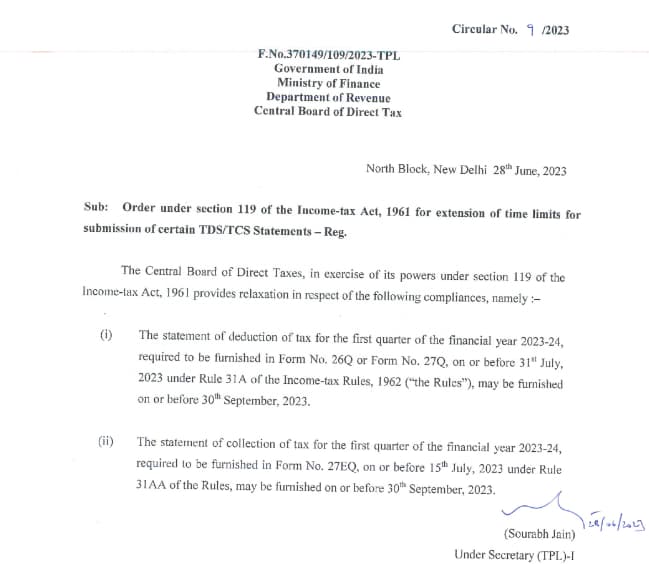

| Latest News |

| TDS Return Due date Extended |

| TDS Return Due date is extended to 30th September 2023. As per the latest circular, TDS return for the first quarter of the financial year 2023-24 to be furnished in form No 26Q/ 27Q on or before 31st July 2023 is extended to 30th September 2023. |

Table of Contents

What is TDS?

TDS refers to the Tax Deducted at Source. It is a specific amount of tax that the Deductor deducts from the taxpayer and deposits into the Central Government account on behalf of the taxpayer. TDS is deducted at the time of making a payment. Therefore, the deductee is eligible to avail credit of the amount so deducted on the basis of form 26AS or TDS certificate issued by the deductor.

TDS Quarterly Return Due Date

TDS return is filed on a quarterly basis. Below is the TDS return due date for Government and other deductors.

| Quarter | TDS Return Due Date |

| April to June 2023 | 31st July 2023 (Extended to 30th Sep 2023) |

| July to Sep 2023 | 31st Oct 2023 |

| Oct to Dec 2023 | 31st Jan 2024 |

| Jan to Mar 2023 | 31st Mar 2024 |

Pre-requisites to filing TDS Return online

Before you go on to file TDS Return you must prepare the TDS return statement. NSDL e-Gov has developed software called e-TDS/TCS Return Preparation Utility (RPU) to facilitate preparation of e-TDS/ TCS returns.

In short, the below three are the pre-requisites required to file quarterly TDS return..

- NSDL e-Gov Return Preparation Utility (RPU) (based on JAVA platform)

- JAVA versions SUN JRE: 1.6 onwards up to JRE: 1.8 update 60

- File Validation Utility (FVU)

How to file TDS Return online?

Below is the step by step procedure to file TDS Return online:

Firstly, you need to install Java to be able to use the NSDL e-Gov Return Preparation Utility (RPU) to prepare your TDS return.

Steps to Install Java

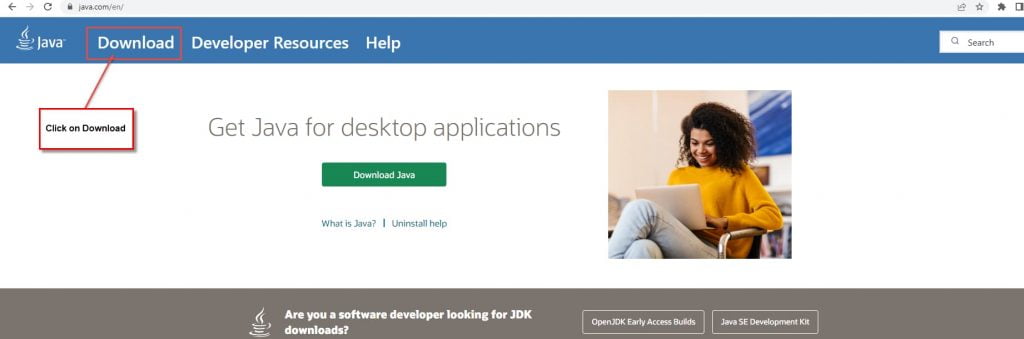

1.Go to the website https://www.java.com/en/

Click on Download.

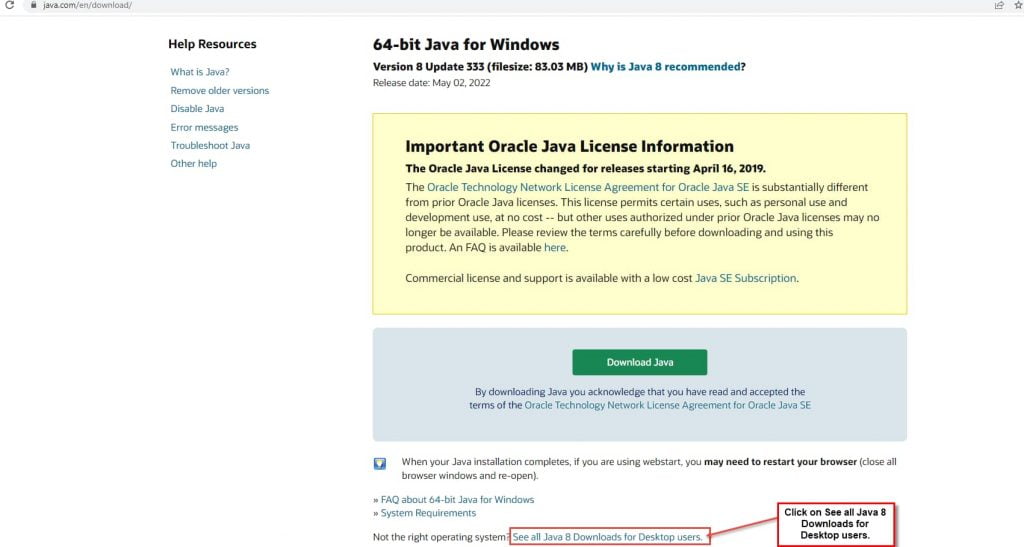

2. Click on “See all Java 8 Downloads for Desktop users.

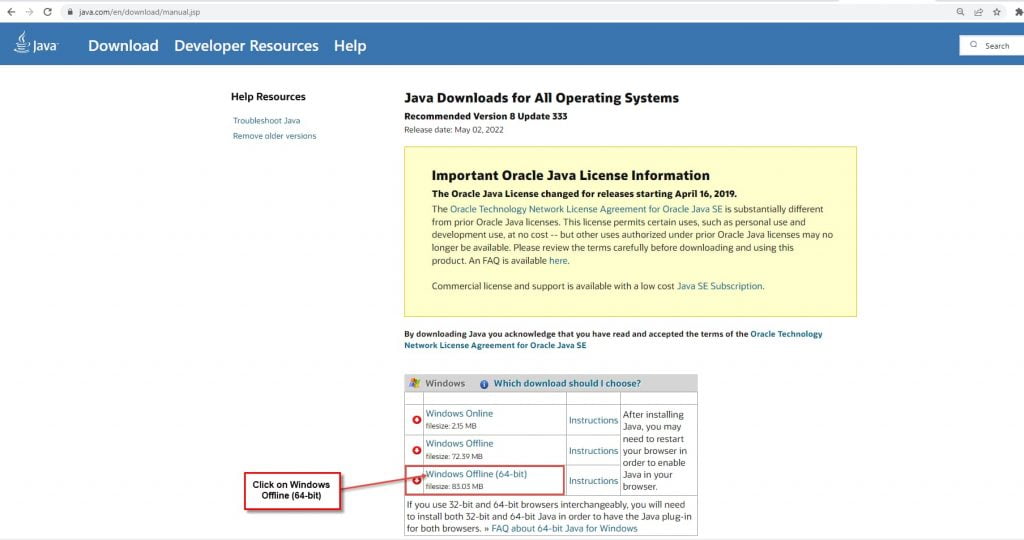

3. You will reach the below screen. Click on “Windows Offline (64-bit)

4.When you click on the download, the file named “jre-8u333-windows-x64” gets downloaded as below.

5.Right click on the file and click on “Run as Administrator”.

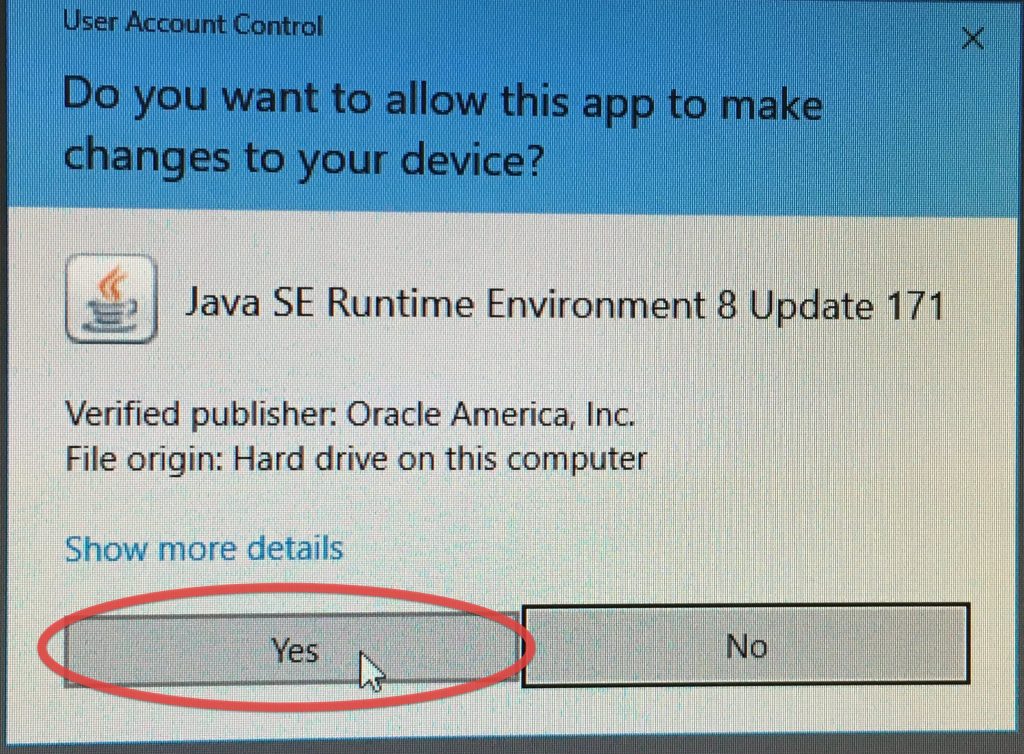

6.When you click on “Run as administrator” you will get the below message

“Do you want to allow this app to make changes to your device”. Click on “Yes”

After installing JAVA file then download the Download RPU version 4.1 from NSDL website

About NSDL e-Gov Return Preparation Utility (RPU)

You may use NSDL e-Gov Return Preparation Utility (RPU) to prepare your quarterly e-TDS/ TCS statement for forms 24Q, 26Q, 27Q and 27EQ (Regular & Correction) for financial year 2007-08 onwards. However, it is not mandatory to use NSDL e-Gov RPU. You may also use other RPU provided by other software vendors.

To download the latest NSDL e-Gov RPU

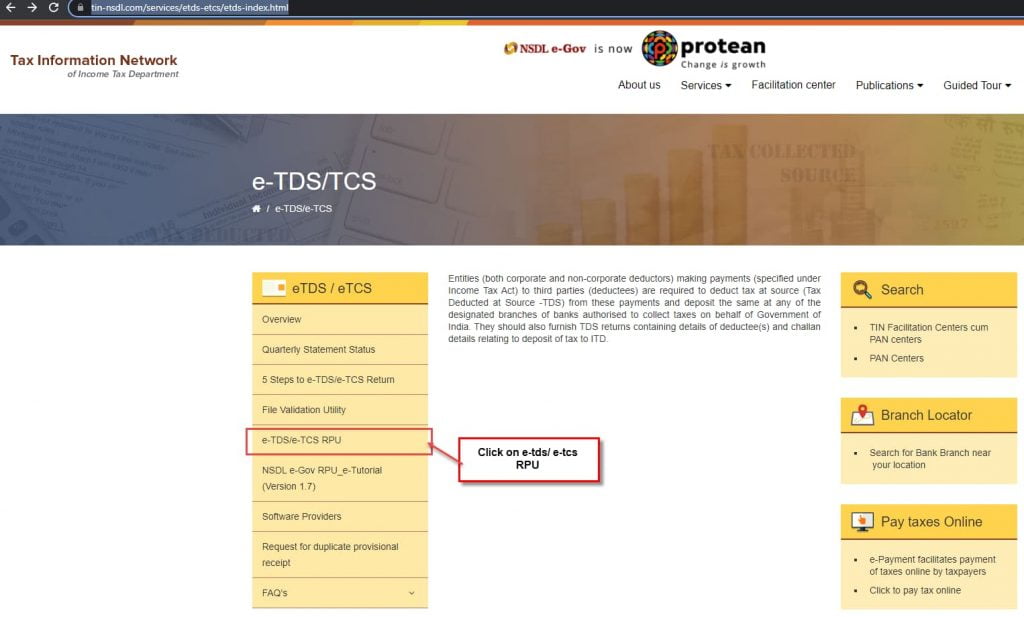

(1) Go to https://www.tin-nsdl.com/services/etds-etcs/etds-index.html.

(2)Click on e-TDS/ e-TCS RPU

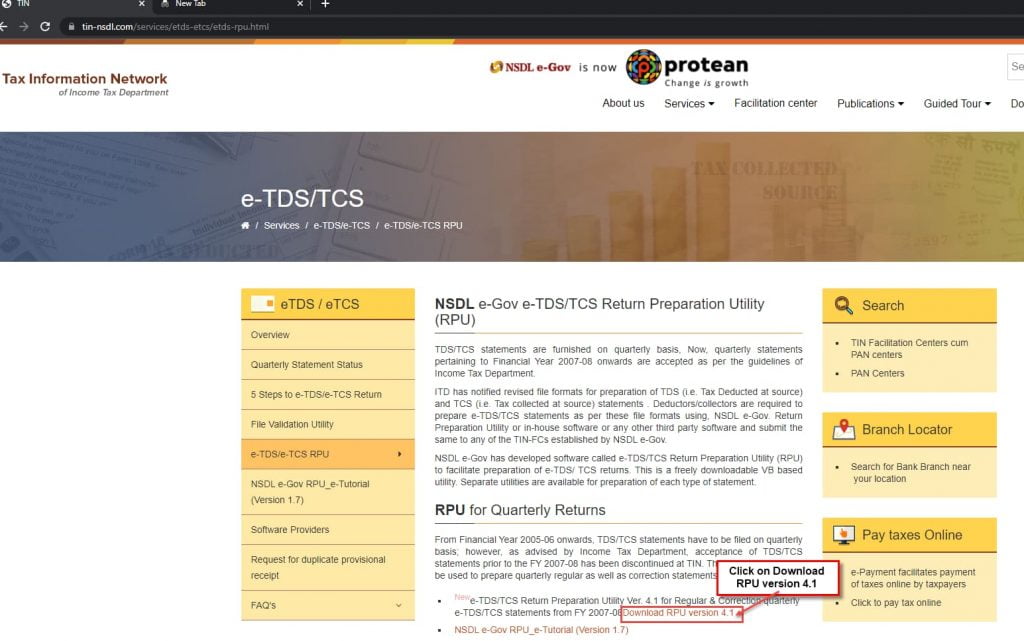

(3) You will reach the below screen. Click on Download RPU version 4.1 to download the file.

(4) A compressed zip file named “TDS_RPU_4.1” will get downloaded as below.

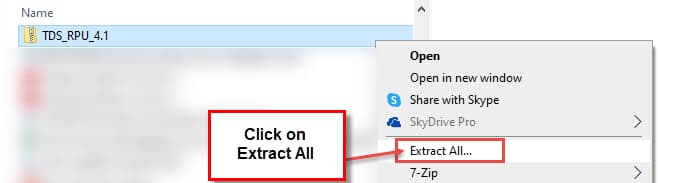

(5)Right click on the zip file and select “Extract All” to extract the zip file to folder

(6) You will see this folder as below. Double click on the folder.

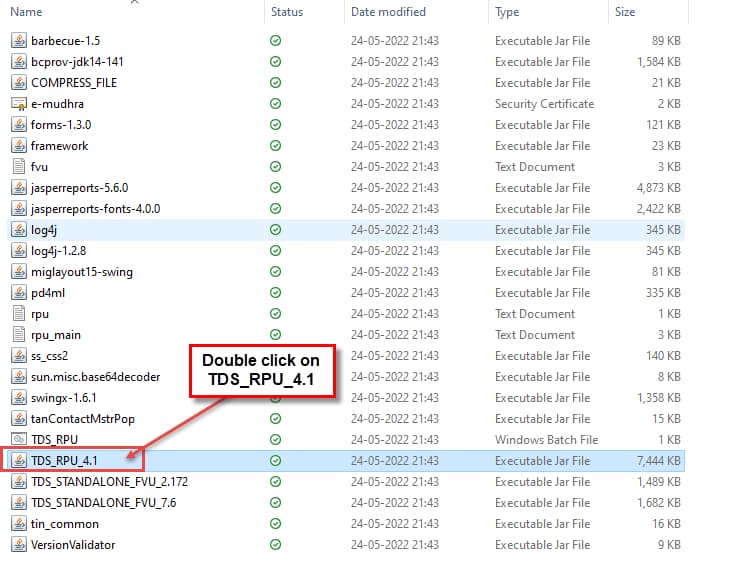

(7) Double click TDS_RPU_4.1(Executable Jar File) as below

(8)You will get the below message. Click on Ok.

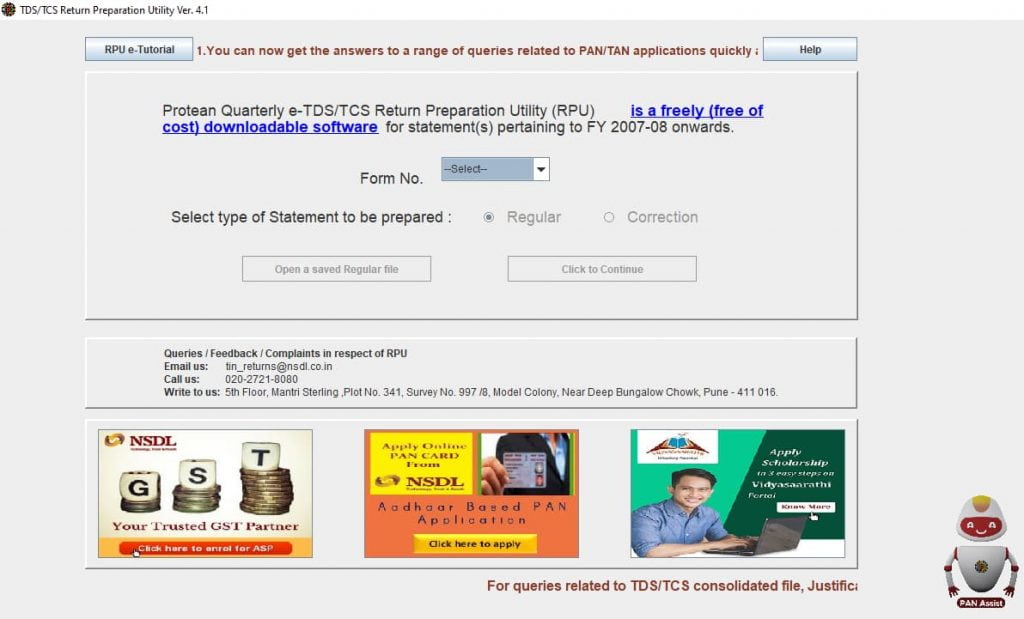

(9)You will reach the below e-TDS/TCS Return Preparation Utility (RPU) screen.

Below are the different types of TDS forms

| Type of TDS Return Forms | Particulars of the TDS Return Forms |

| Form 24Q | Statement for tax deducted at source from salaries |

| Form 26Q | Statement for tax deducted at source on all payments other than salaries. |

| Form 27Q | Statement for tax deduction on income received from interest, dividends, or any other sum payable to non residents. |

| Form 27EQ | Statement of collection of tax at source. |

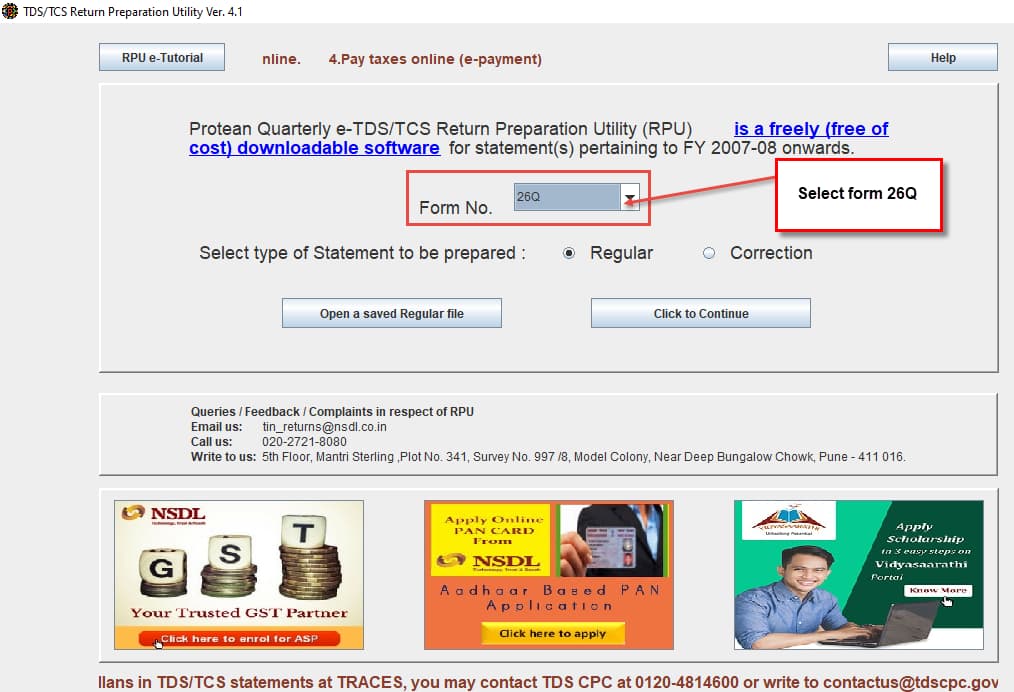

(10) Select the Form no based on the purpose of filing your TDS return.

(11) Click on Continue.

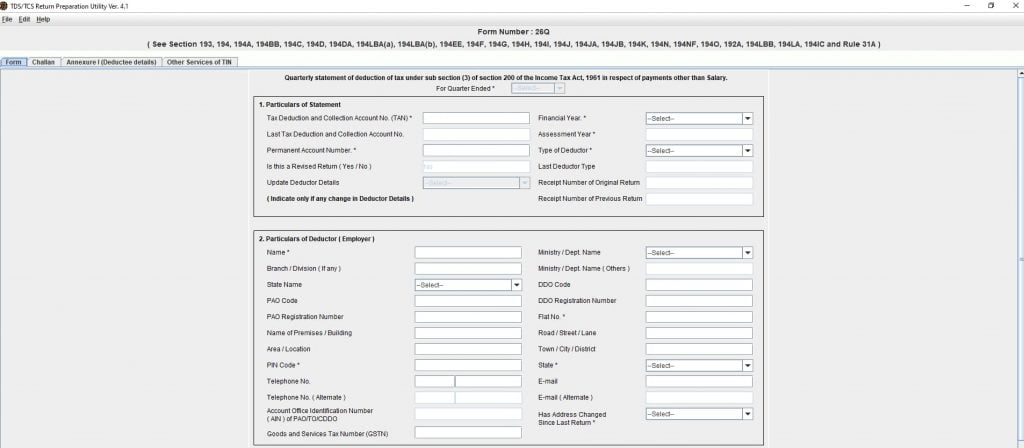

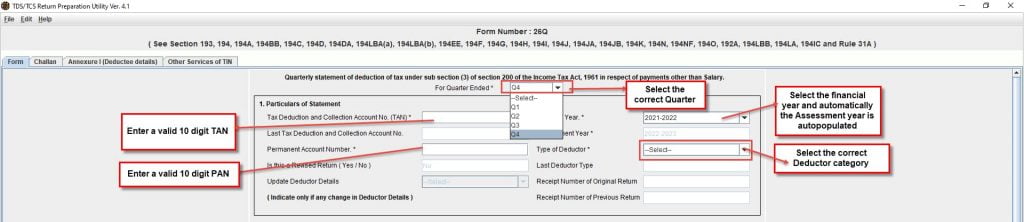

(12)Form 26Q opens as follows:

Note that you will able to prepare TDS return statement only after the completion of the relevant quarter of the selected financial year.

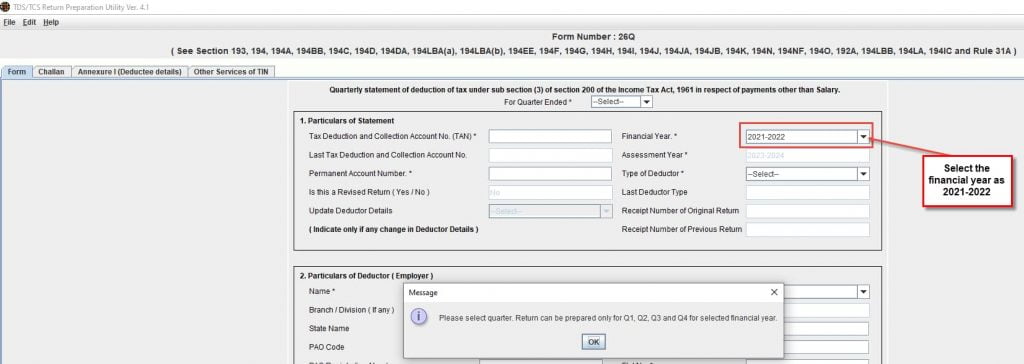

(13)Select the relevant financial year 2021-2022. Once you select the financial year, you will get the message “Please select quarter. Quarter can be prepared only for Q1, Q2, Q3 and Q4 for selected financial year”. Click on OK.

(14) Now, lets start filling the 1st section of the form 26Q- Particulars of Statement.

(i) Once you select the financial year as 2021-2022, the assessment year is auto-populated as 2022-2023.

(ii) Select the correct quarter of the specific financial year.

(iii) Enter a valid 10 digit TAN in the specific field.

(iv) Enter a valid 10 digit PAN in the specific field.

(v) Select the Deductor category from the drop down as applicable to you.

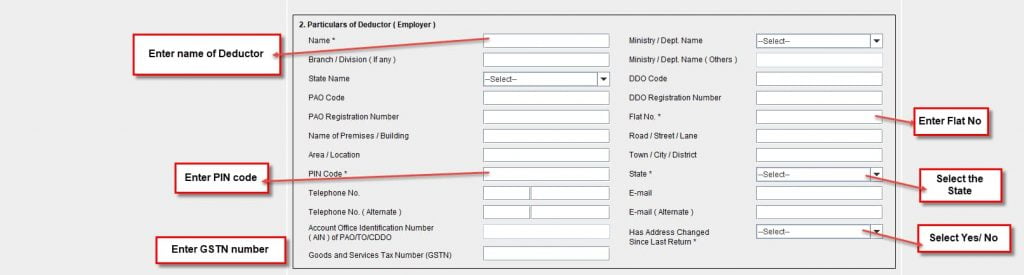

(15) Enter details of Deductor in the specified fields.

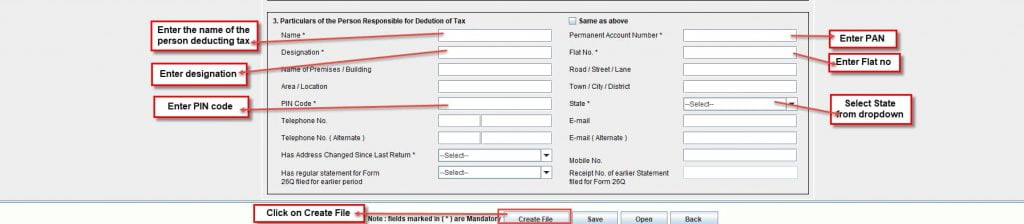

(16) Enter details of person deducting tax. If Deductor (Employer) and the person deducting tax is the same then select the checkbox “Same as above”.

(17) After entering the above details, click on create file or save.

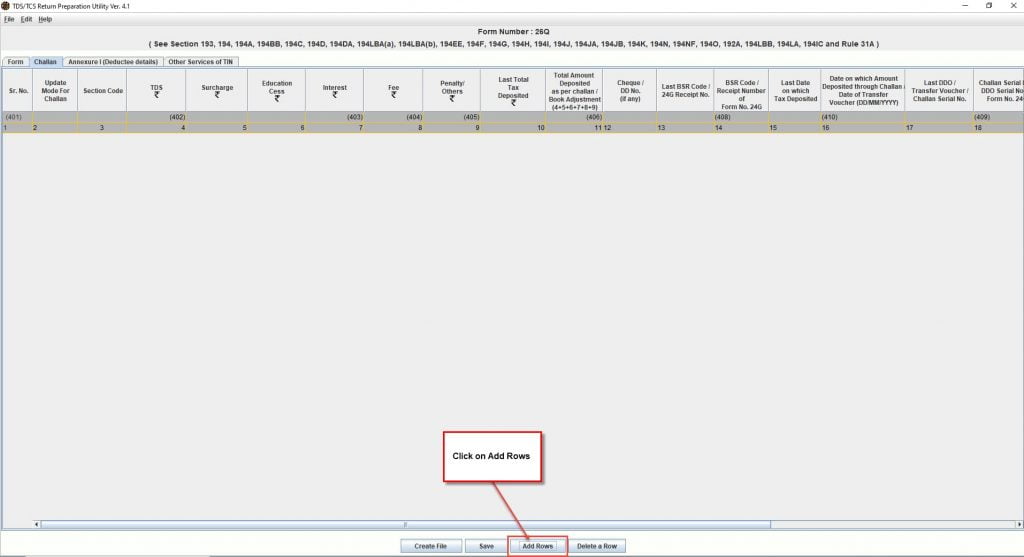

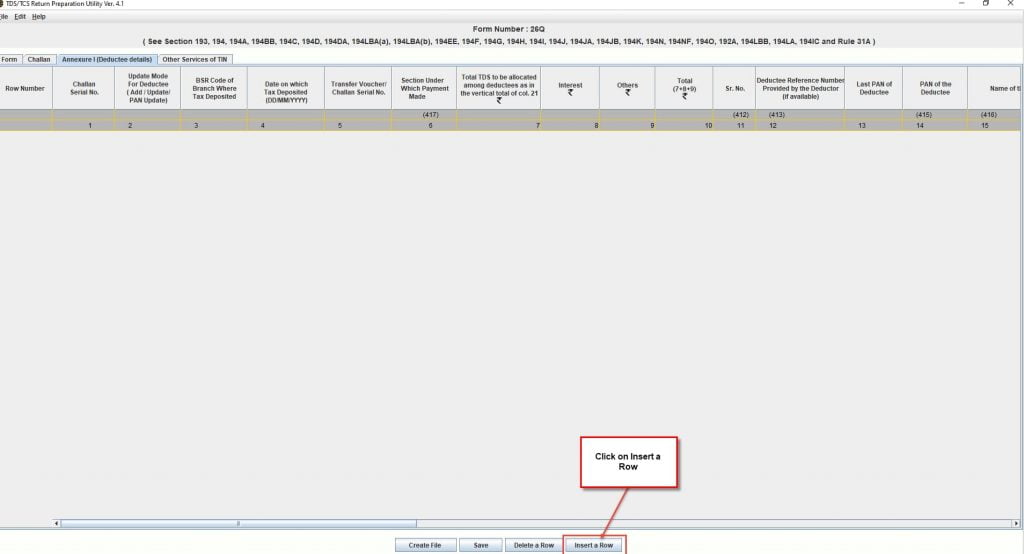

(18) Click on the tab next to the form- Challan and click on “Add Rows”

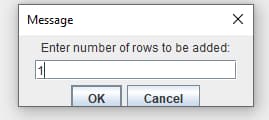

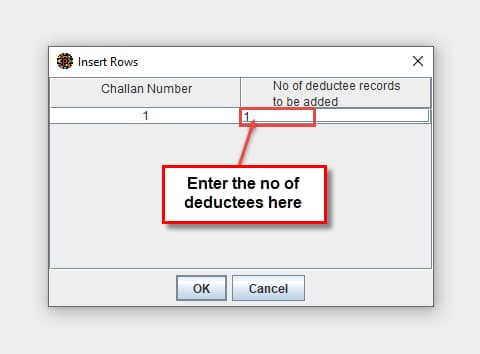

(19)When you click on Add rows you will get the below message. Enter the number of rows based on how may deductee details you want to enter. And click on OK.

(20)Then enter the following challan details

(i)TDS amount paid

(ii) BSR code of TDS challan

(iii) Date on which challan was deposited

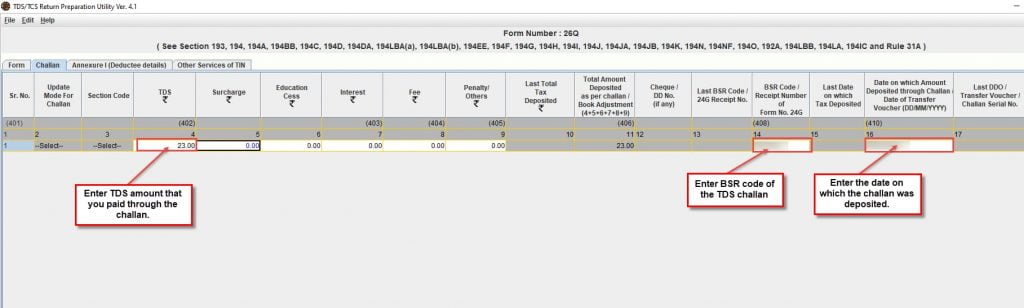

(21) Scroll towards your right and enter the other challan details as follows

(i)Challan serial number

(ii) Type of TDS payment made

(a)200 – For TDS/ TCS payable by taxpayer or

(b)400- For TDS/ TCS Regular assessment

(22) Now, click on save to save the data entered.

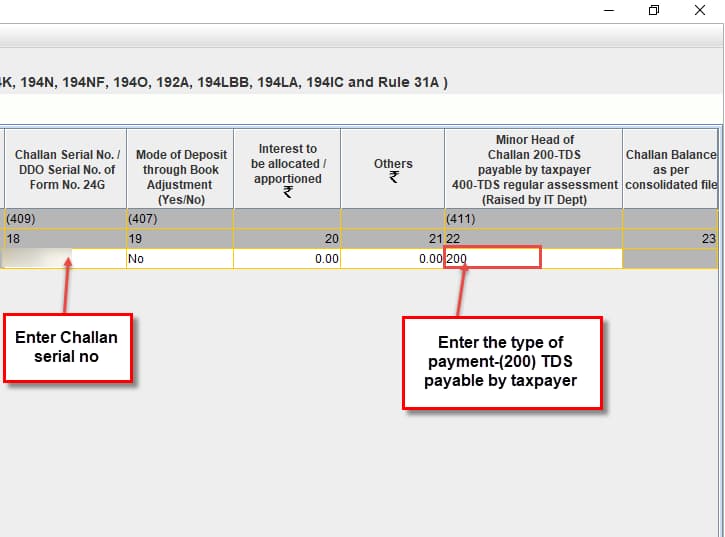

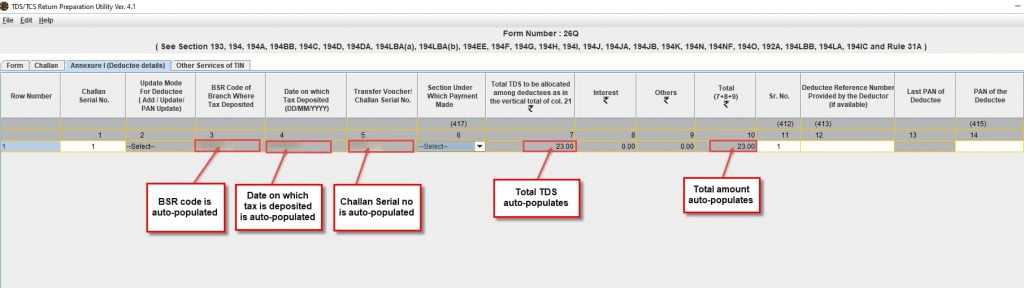

(23) Click on the next tab- Annexture-I (Deductee details). And then click on “Insert a Row”.

(25)Some of the fields in Deductee details are auto-populated such as

(i) BSR code

(ii) Date on which tax is deposited

(iii) Challan serial number

(iv) Total TDS amount paid

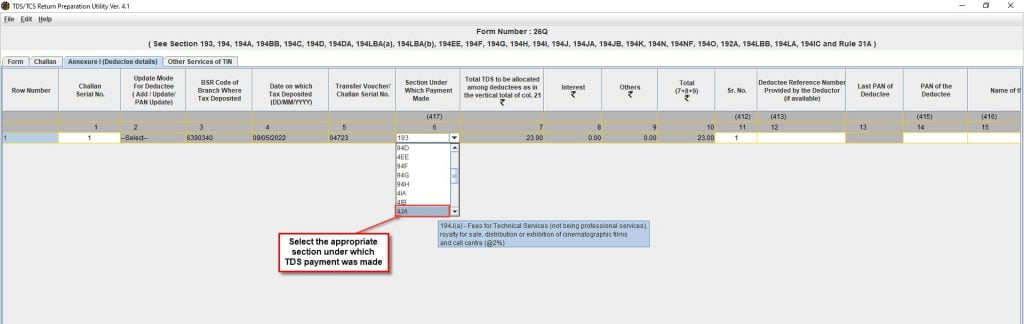

(26) Select the appropriate section under which TDS payment was made. Hover over the section and you will be able to see the description. This will help you in selecting the correct section.

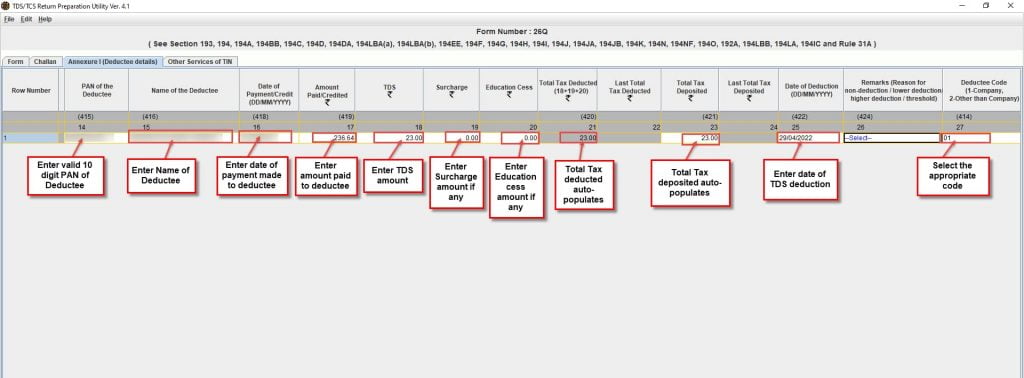

(27) Scroll towards your right and fill the fields 14 to 27 as below

(i) Enter valid 10 digit PAN of Deductee

(ii) Enter the name of Deductee

(iii) Enter the date of payment made to deductee

( iv) Enter the amount paid to deductee

(v) Enter the TDS amount

(vi) Enter the surcharge amount (if any)

(vii) Enter the education cess amount (if any)

(viii) The Total tax deducted auto-populates

(ix) The total tax deposited auto-populates

(x) Enter the date of TDS deduction done.

(xi) Select the appropriate code

(a) Code-01 for Company

(b) Code-02 for other than company

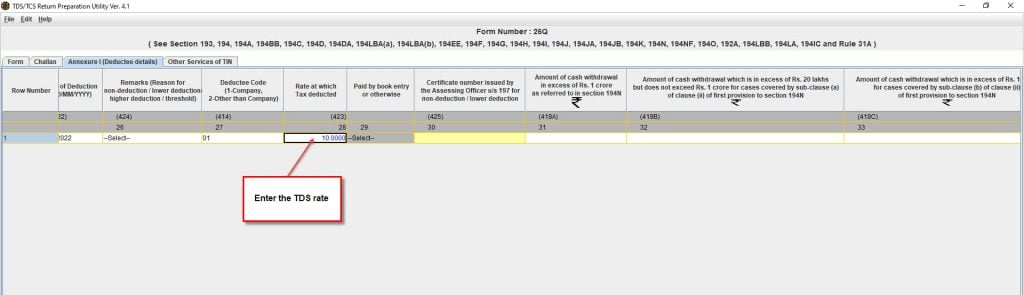

(28)Scroll further towards your right to fill the fields 28 to 33. Enter the TDS rate of deduction applied on the deductee. Click on Save.

(29) Now, you have completed preparing the tax return form 26Q. Prepare the tax return form in clean text ASCII format with ‘txt’ as filename extension. In case you are using NSDL RPU, which is an excel based utility, click the “create file” icon to generate the text file after the data has been entered correctly.

(30) Once the file has been prepared as per the file format, it should be verified using the File Validation Utility (FVU) provided by NSDL e-Gov.

(31) File Validation Utility (FVU)

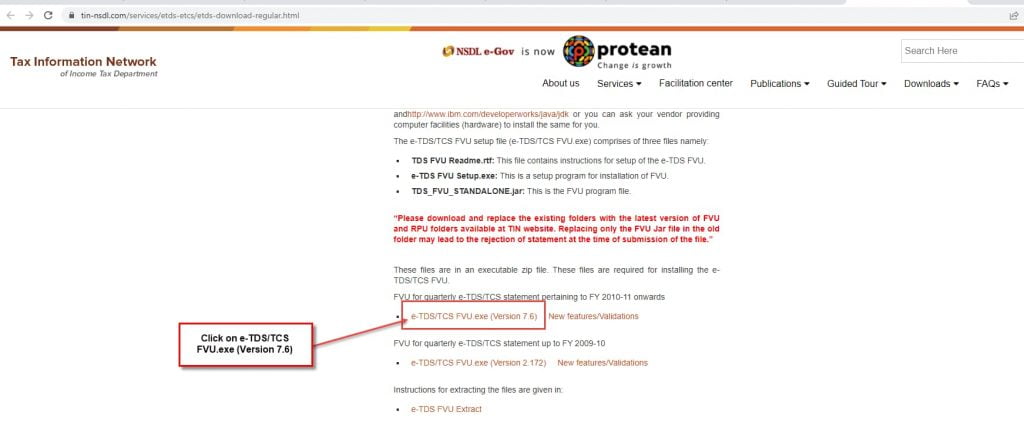

To verify using the File validation utility (FVU) you must install FVU for quarterly e-TDS/TCS statement pertaining to FY 2010-11 onwards. The e-TDS/TCS FVU setup file (e-TDS/TCS FVU.exe) comprises of three files namely:

- TDS FVU Readme.rtf: This file contains instructions for setup of the e-TDS FVU.

- e-TDS FVU Setup.exe: This is a setup program for installation of FVU.

- TDS_FVU_STANDALONE.jar: This is the FVU program file.

(i)To download FVU click on the below link

https://www.tin-nsdl.com/services/etds-etcs/etds-download-regular.html

(ii)Scroll down to the bottom of the page. You will find link to download zip file named ” e-TDS/TCS FVU.exe (Version 7.6)

(iii) You will find the below zip file. Click on Extract all to extract the file to folder.

(iv) Once the FVU installation is complete, run the e-TDS return file prepared in .txt format through FVU to verify.

(v) In case file has any errors the FVU will give a report of the errors. Rectify the errors and verify the file again through the FVU.

(vi) Upon successful validation of the file for Form No. 26Q, the FVU will generate three files as follows:

i. FORM26Q.html is a ‘TDS / TCS Return Statistics Report’

ii. FORM 26Q_PAN_Statistics.html -PAN Statistics Report and

iii. FORM26Q.fvu – ‘upload file’

(32) Filing of TDS Return

To file your quarterly TDS return follow the below steps:

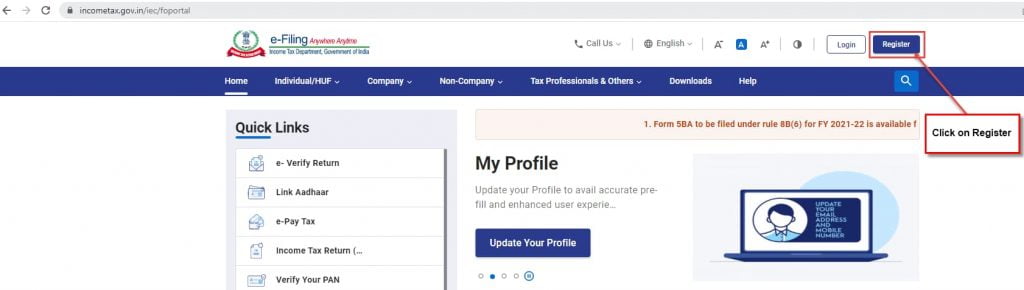

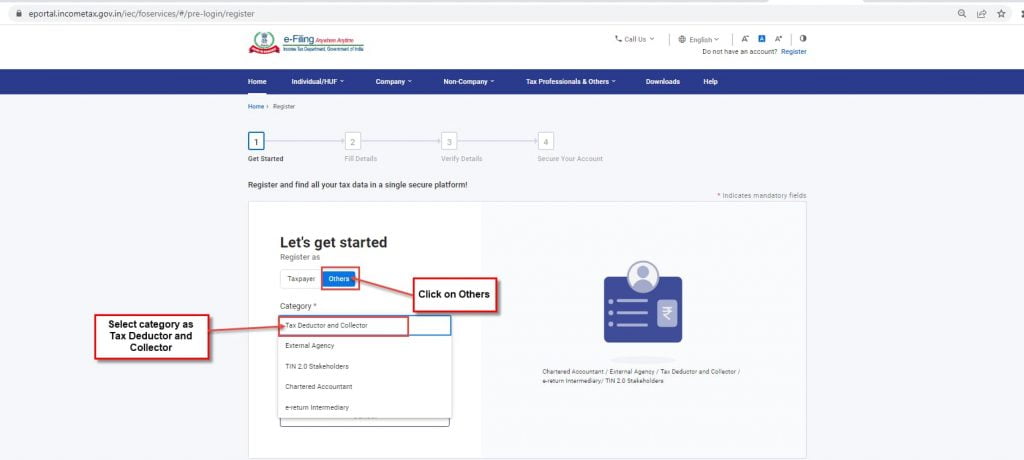

1.Register as Tax Deductor or Collector on the income tax website

(i) Go to the official income tax website https://www.incometax.gov.in/iec/foportal

(ii) Firstly, register yourself as as Tax Deductor on the income tax portal. Click on Register

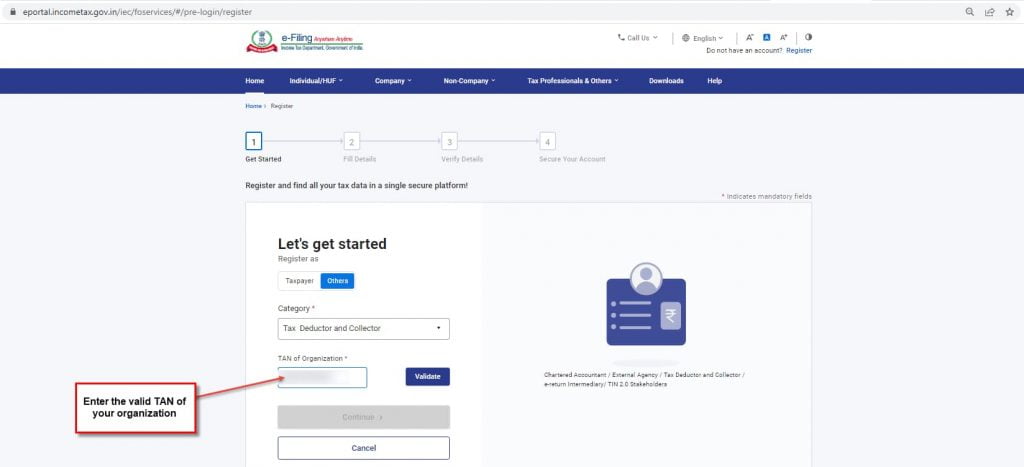

(iii) Select Register as Others and the category as Tax Deductor and Collector.

(iv) Enter TAN of organization and click on validate.

(v) Now enter the basic details, person responsible for making the payment and contact details.

(vi) Then, OTP will be sent to your registered mobile number and email id. Enter the OTPs and click on confirm.

(vii) You must set your password and then click on the Register button.

(viii) You will get the message “Registered successfully”.

2.Login with your credentials

(i) Enter your valid TAN as your User ID.

You will get the error message “The e-filing account associated with the above User Id has not been activated, kindly activate your User Id to login to e-filing portal.

3. Activate your TAN

(i) Login with your PAN and go to pending action.

(ii) You will see your TAN, registration date and other details.

(iii) You will also see the buttons Approve, Reject and Vie/ Edit details button. Click on the Approve button.

(iv) Now, you will get the message “TAN approved” and TAN registered successfully.

4. Login with your TAN credentials and start filing your TDS return.

5. Go to e-file>File income tax forms

6.You will see lot of forms. Scroll down to the Deduction of tax at source form. Click on “File Now”.

7.Click on Let’s get started.

8.In the next screen, select the appropriate form (example form 26Q-Quaterly TDS return for other than salary). TAN will auto-populate.

9.Select the current financial year, quarter for which you are filing the TDS return. Then click on Fetch details and the Upload type will get activated.

10.Under Upload file, you need to upload .fvu zip file. Then click on Proceed to E-verify.

11.OTP will be sent to the authorized signatory. Enter the OTP and your quarterly TDS return will be filed successfully.

e-TDS Status

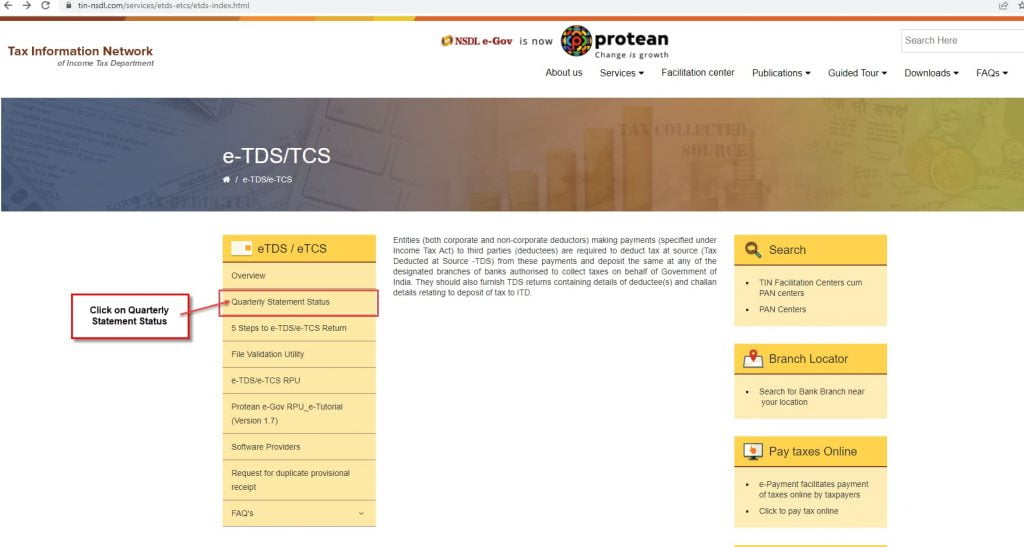

Below are the steps to check your e-TDS status:

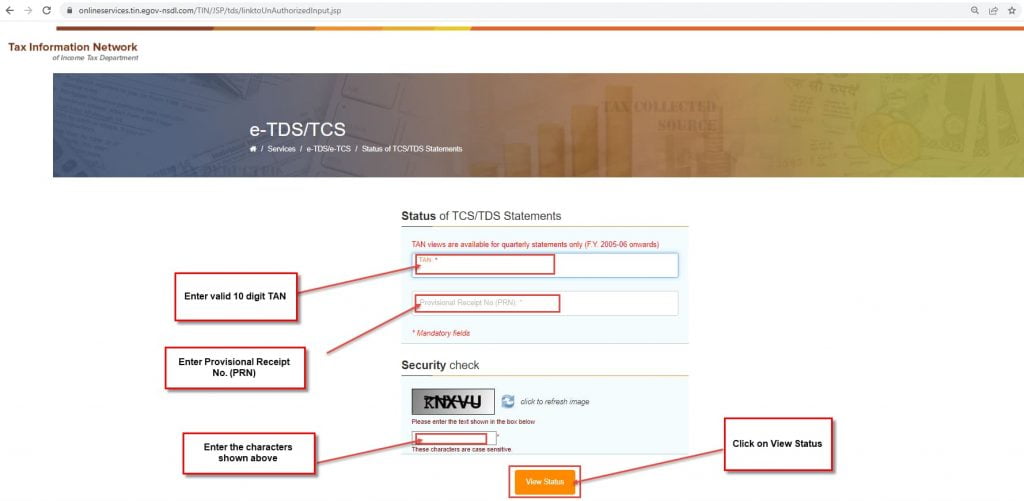

1.Go to the NSDL website https://www.tin-nsdl.com/services/etds-etcs/etds-index.html

2. In the below screen, click on Quarterly Statement Status.

3. You will reach the below screen. In the below scree, enter TAN, Provisional receipt number, characters shown in image. Then, click on View status to know your e-TDS/ TCS status.

Faqs

1.What is the TDS return due date for Q1 of FY 2023-24?

TDS return due date for Q1 of FY 2023-24 to be furnished using form 24Q is 31st July 2023.

TDS return due date for Q1 of FY 2023-24 to be furnished using form 26Q and 27Q is extended from 31st July 2023 to 30th Sep 2023.

2.What is 24Q and 26Q due date?

Form 24Q is a statement of TDS deduction from salaries. The due date for filing form 24Q is 31st July 2023. There is no extension.

Form 26Q is a statement of TDS deduction on all payments other than salaries. As per the latest circular, the due date for filing form 26Q is extended to 30th Sep 2023.

3. Is due date for TDS return extended?

Yes, TDS return due date is extended to 30th Sep 2023. Note that the extension is applicable only for forms 26Q and 27Q.

4.What is the last date for 26Q?

The last date for 26Q is 30th Sep 2023.