Link PAN to Aadhar by 30th June 2023 to continue your financial transactions. In other words, you will be able to buy or withdraw money only if you link PAN to Aadhar before the deadline.

Linking PAN with Aadhaar is a simple process. Yet, if you need help, check out How to link aadhaar with PAN card online step by step given below.

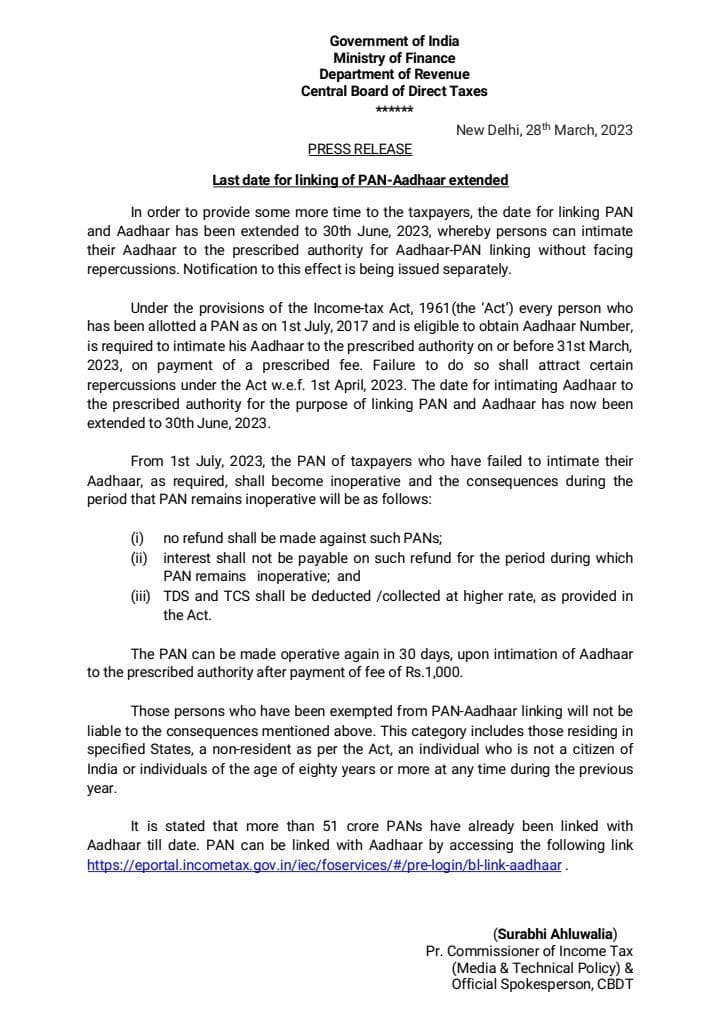

Latest news on 28th Mar 2023

The last date to link PAN to Aadhar is extended from 31st March 2023 to 30th June 2023.

If you are linking PAN to Aadhar, fees are applicable based on the date of issue of PAN.

| Date of issue of PAN | Fees |

| PAN issued before 1st July 2017 | Rs 1000 |

| PAN issued on or after1st July 2017 | Not applicable |

You must pay the fees through e-Pay Tax functionality on e-filing portal for linking PAN with Aadhaar.

Steps for payment through e-Pay Tax

- Provide your PAN, Confirm PAN and Mobile number to receive OTP Or navigate to post login e-File > e-Pay Tax> Select New Payment

- Post OTP verification, you will be redirected to a page showing different payment tiles

- Click Proceed on the Income Tax tile

- Select AY as 2024-25 and Type of Payment – as other Receipts (500) and Continue

- Preview the amount as Rs. 1000 under ‘Others’ field in tax break-up and proceed with further steps

Payment Verification Method:

- Taxpayer will receive challan receipt on successful payment. User can also check bank account statement to ensure if amount was deducted or not.

- Taxpayer can view and download the challan by navigating to e-File > e-Pay Tax> Payment History or check the challan status through “Know Payment Status” under Quick Links on e-Filing Home page.

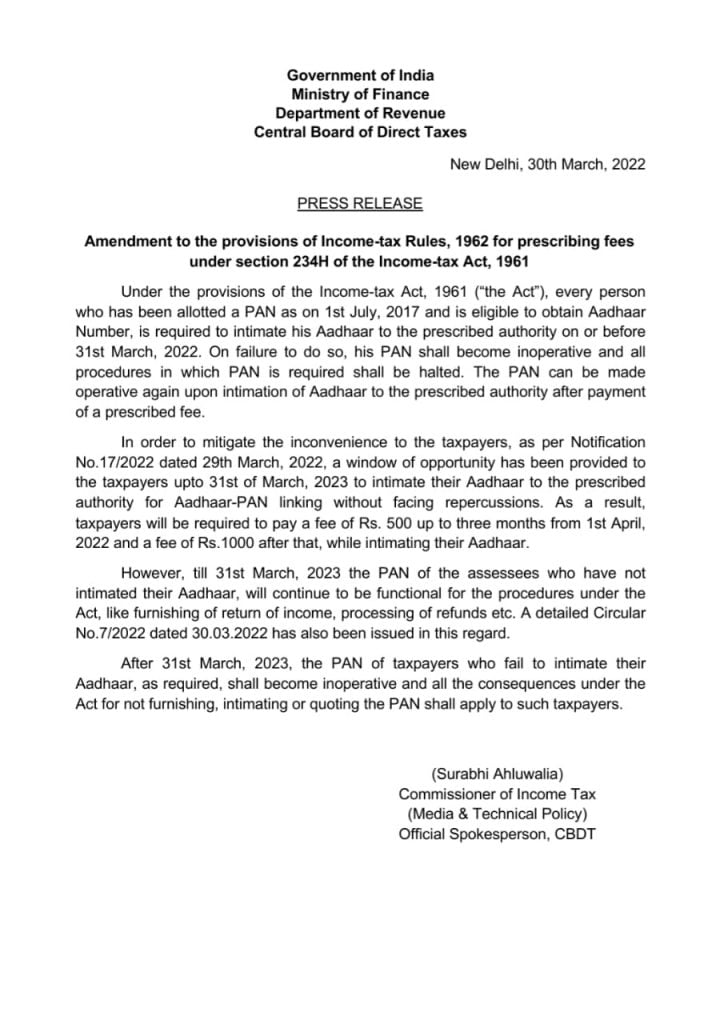

Latest news on 10th June 2022

The last date to link PAN to Aadhar is extended from 31st March 2022 to 31st March 2023. However, taxpayers linking PAN to Aadhar have to pay certain fees after 31st March 2022.

If you are linking PAN to Aadhar, you must pay below fees.

| Date | Fees |

| 1st April 2022 to 30th June 2022 | Rs 500 |

| 1st July 2022 to 31st March 2023 | Rs 1000 |

Below is the press release of extension of last date to link PAN to Aadhar.

Table of Contents

How to Link PAN to Aadhar?

You as a taxpayer can link PAN with Aadhaar either using e-filing portal or by using SMS facility or by visiting your nearest PAN centre.

Link PAN to Aadhar using Income Tax e-Filing website

Below is the procedure to link PAN to Aadhar using an e-filing portal

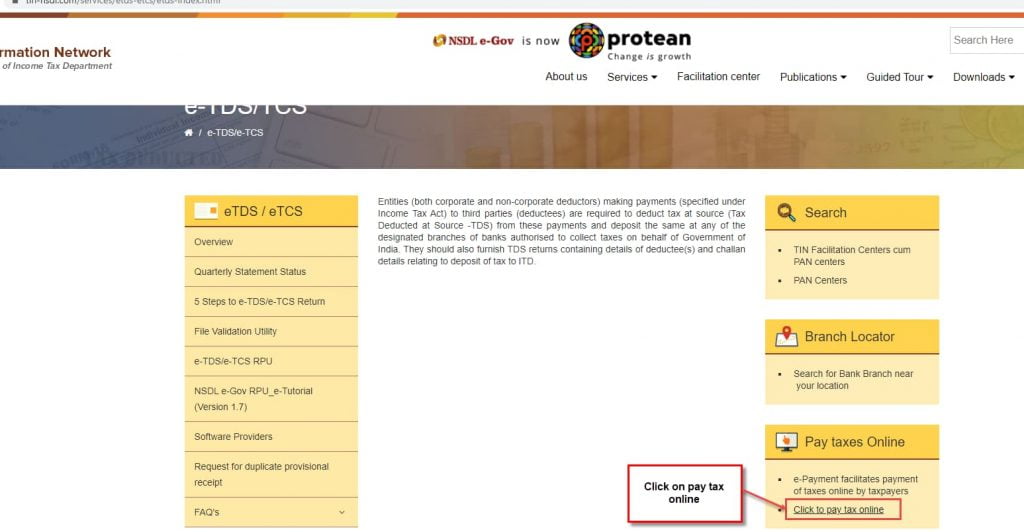

Firstly, you must pay the fee on NSDL website before linking PAN to Aadhar if you are linking after 31st March 2022.

(1) Go to the NSDL website https://www.tin-nsdl.com/services/etds-etcs/etds-index.html and click on “Click to pay tax online”.

(2) You will reach the below screen. Click on proceed under challan no/ ITNS 280 which is for Non-TDS/ TCS.

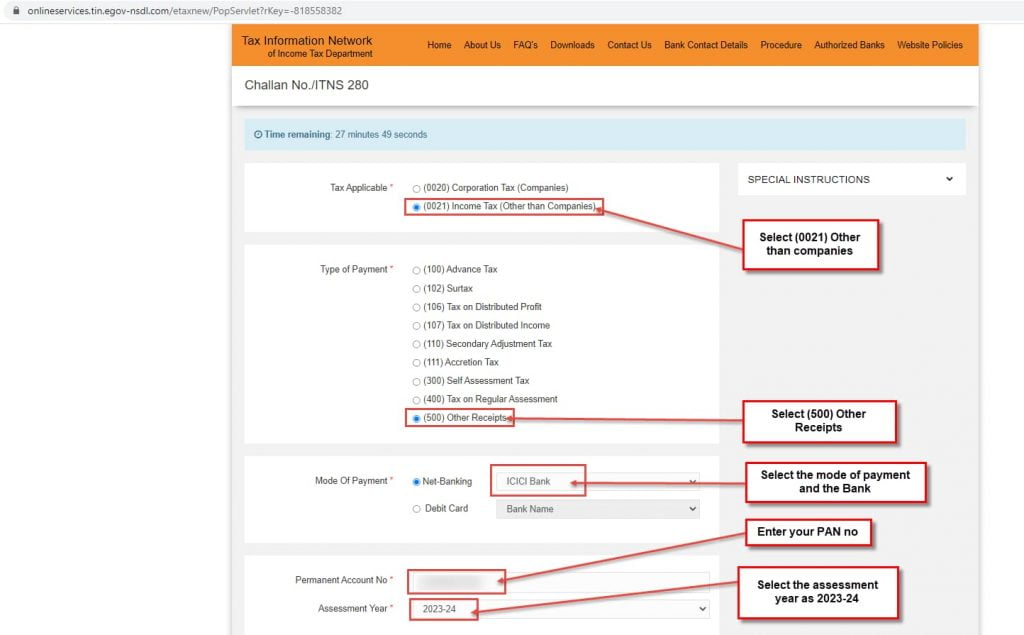

(3) Select Tax Applicable as “(0021) Other than Companies”. (See below snapshot after point7)

(4) Select type of payment as “(500) Other Receipts”.(See below snapshot after point7)

(5) Select mode of payment and the bank.(See below snapshot after point7)

(6) Enter your valid PAN no.(See below snapshot after point7)

(7) Ensure that you select the assessment year as 2023-24 only.

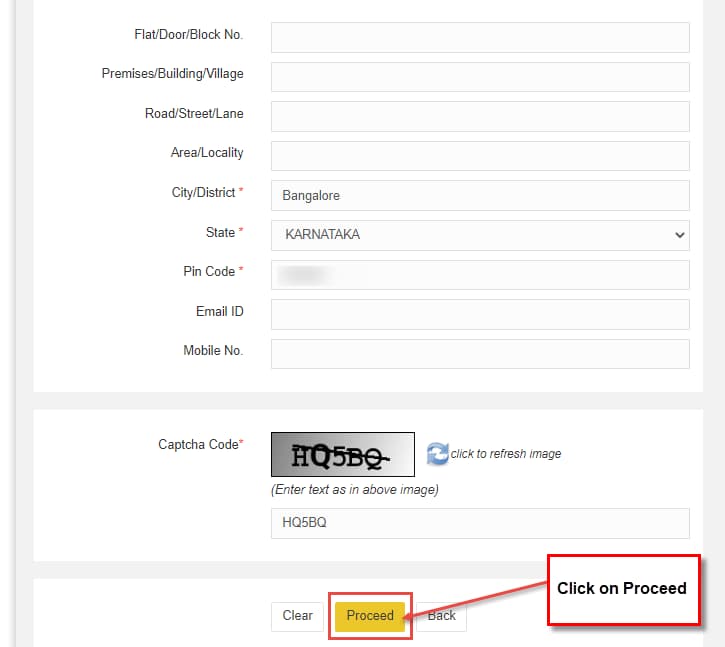

(8) Enter City/ District, Select state, enter pin code, enter captcha code. Then, click on Proceed as shown below.

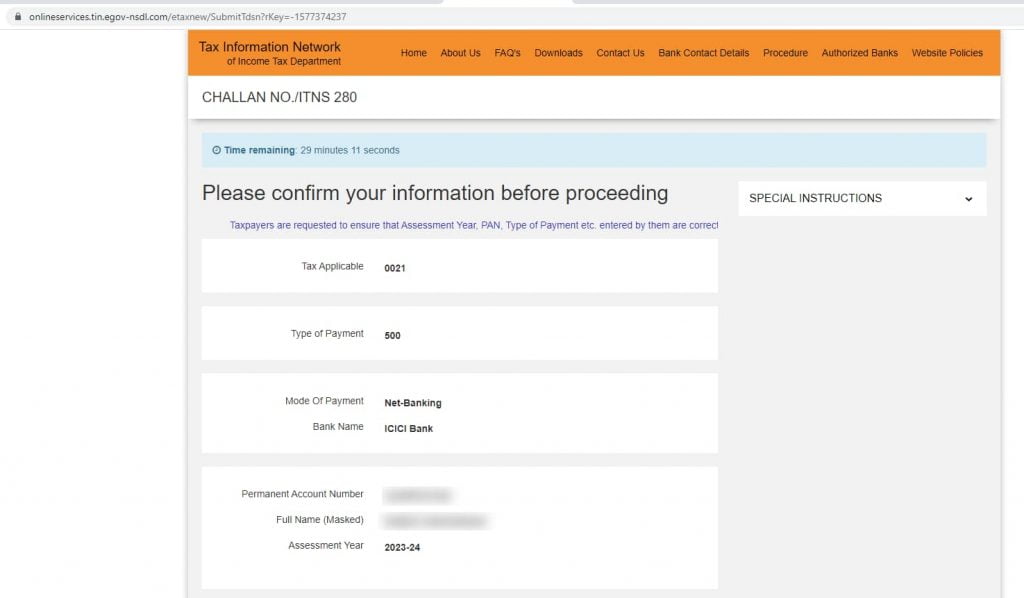

(9) When you click on Proceed, you will reach the below screen.

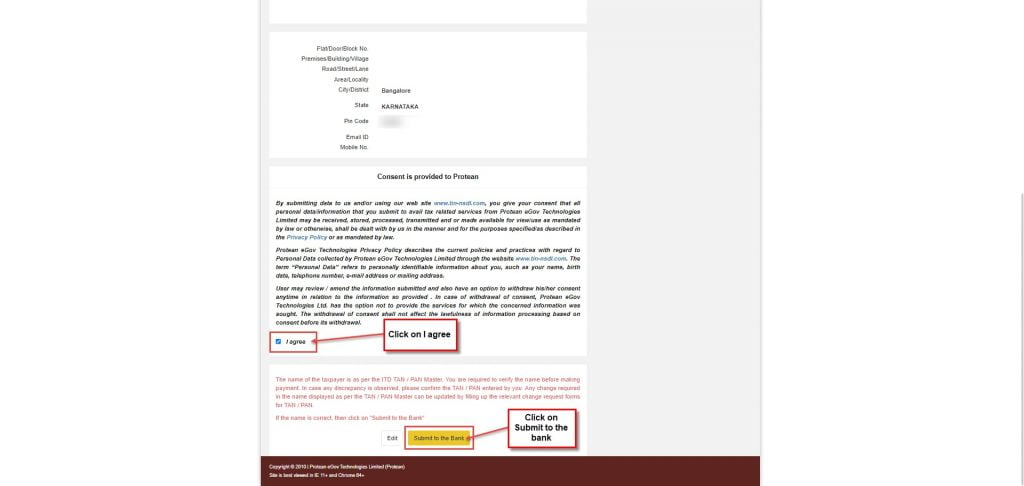

(10) Click on “I agree” and then click on “submit to the bank”.

(11) You will be redirected to the Bank page. Login with bank credentials and make the payment.

(12) After paying the applicable fees, submit the PAN-Aadhaar link request on e-Filing portal after 4-5 working days of making fee payment.

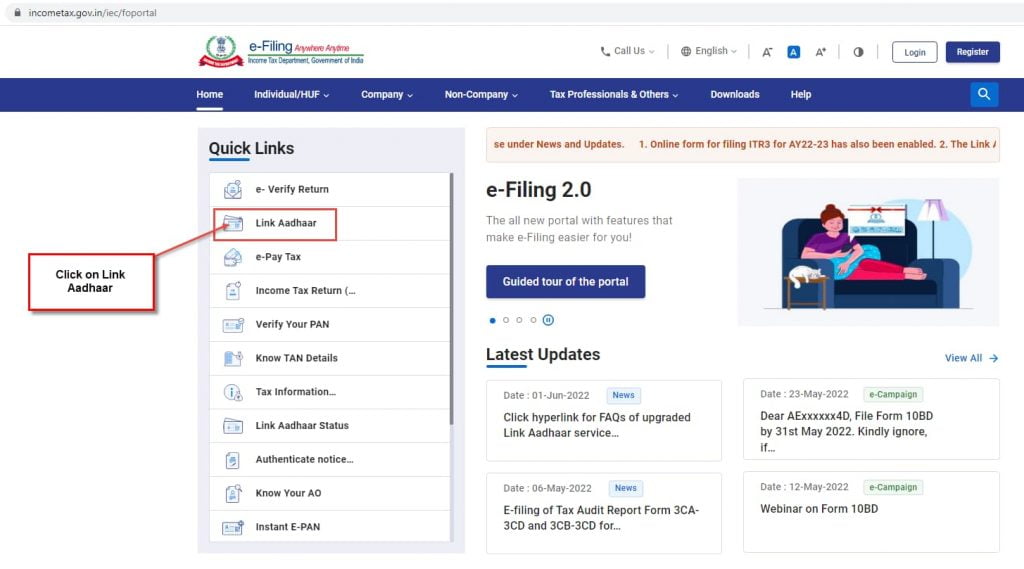

(13) Go to the official income tax filing website https://www.incometax.gov.in/iec/foportal/

(14) The Link Aadhaar facility is available to individual taxpayers (both registered and unregistered on e-Filing) who have a valid PAN and Aadhaar number.

(15) Login to the income tax portal with your credentials.

(16) Click on “Link Aadhaar” under Quick links.

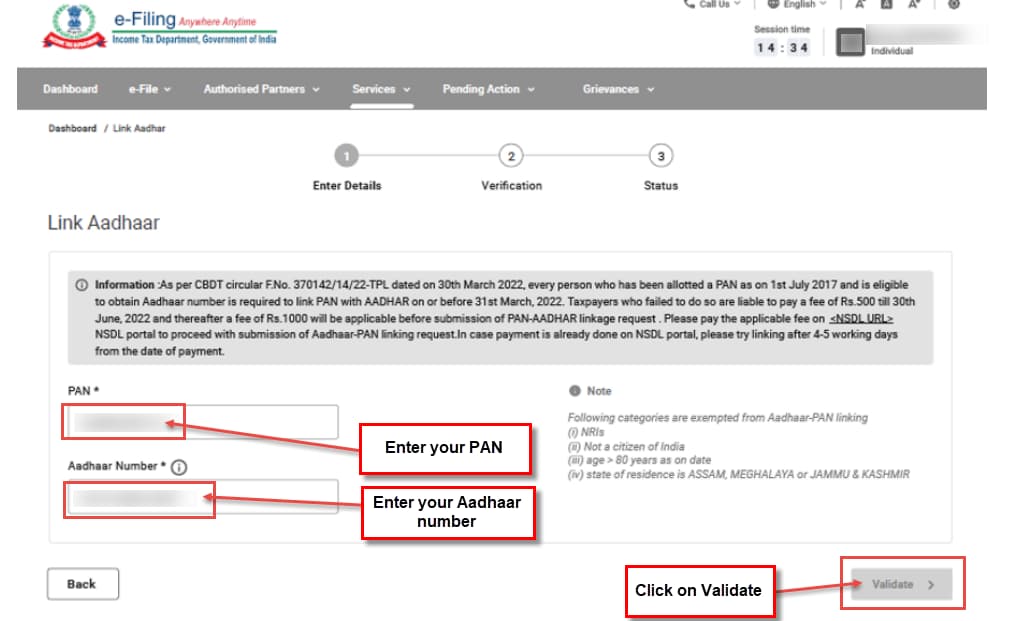

(17) You will reach the below screen. Enter your PAN and Aadhaar number correctly. Then click on validate.

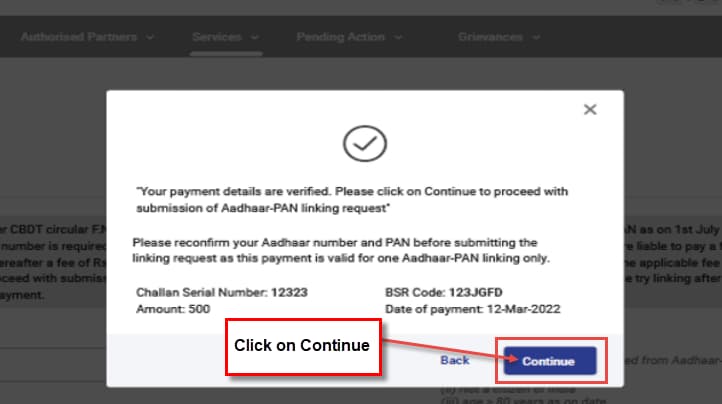

(18) After validating PAN and Aadhar, you will see a pop-up message that “Your payments details are verified”. Click Continue on the pop-up message to submit Aadhaar link request.

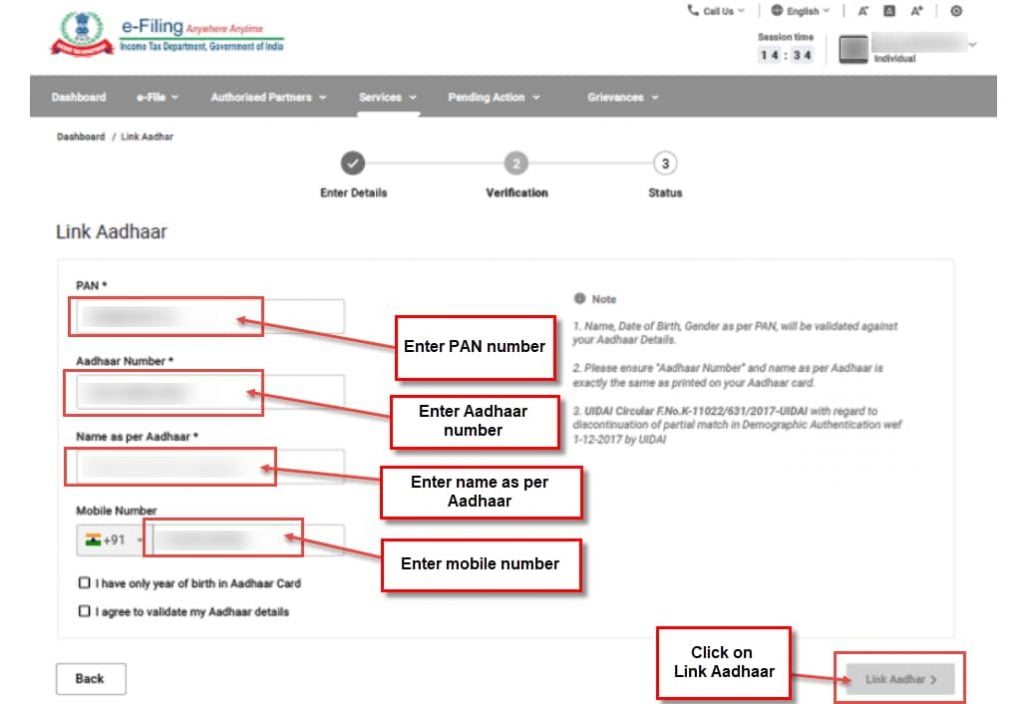

(19) Enter PAN number, Aadhaar number, Name as per Aadhaar and mobile number. Click on “Link Aadhaar“.

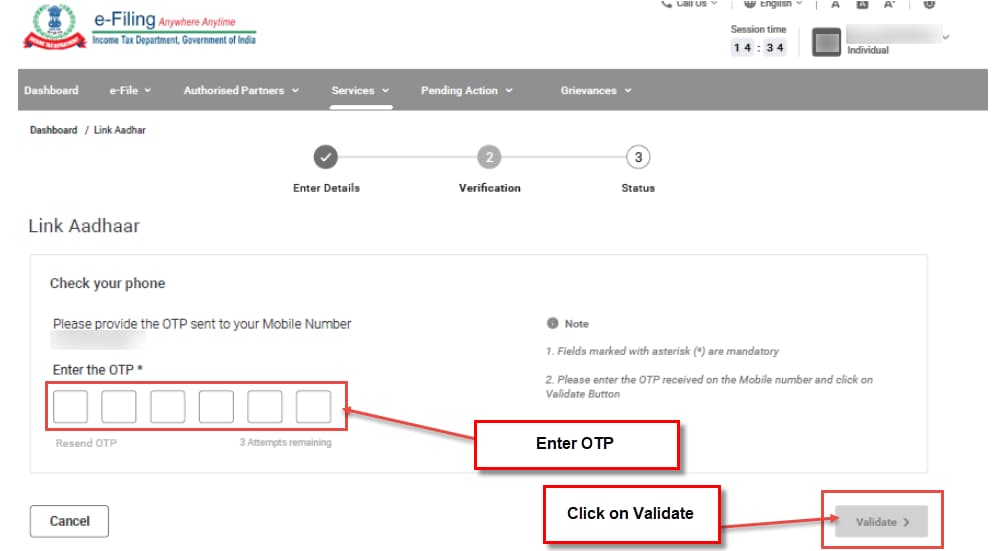

(20) When you click on “Link Aadhaar” you will reach the below screen. Enter the 6-digit OTP received on mobile number. And click on “Validate”.

(21) That’s it; Now, if the name and date of birth in PAN card and Aadhaar are identical, Aadhaar will be linked to your PAN.

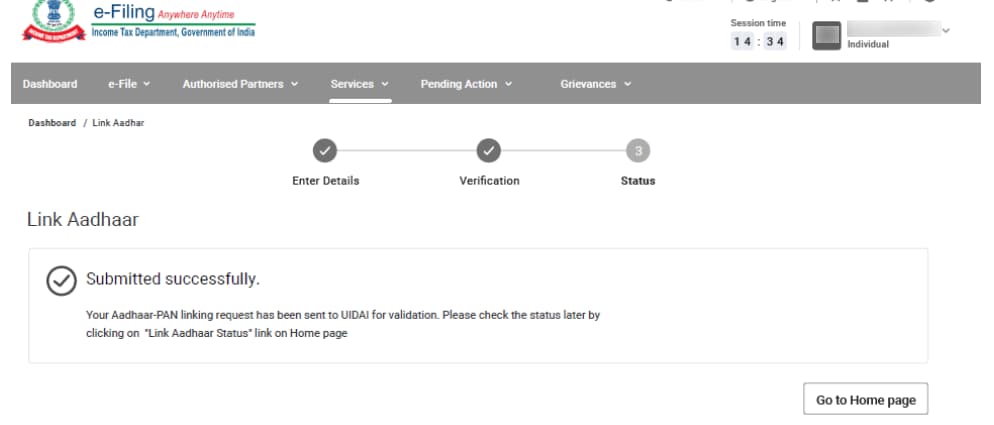

Now, your Request for link of Aadhaar has been submitted successfully. You will get the below message.

How to Link PAN to Aadhar by SMS?

Below is the procedure to link PAN with Aadhaar using sms facility

(1)Send SMS to 567678 or 56161 in following format:

UIDPAN<space><12 digit Aadhaar><space><10 digit PAN>

Example of SMS to 567678 or 56161:

UIDPAN 111122223333 AAAPA9999Q

Is it Mandatory to Link PAN to Aadhar?

PAN not linked to the Aadhaar number will likely become invalid after 30th September 2021.

Section 139AA of the Income-tax Act, 1961, as introduced by the Finance Act, 2017, provides for mandatory quoting of the Aadhaar /Enrolment ID of the Aadhaar application form to file the return of income.

Suppose the taxpayer does not have an Aadhaar number. In that case, he can quote the EID number mentioned on the Acknowledgement/ EID slip provided by the enrollment centre at the time of enrollment while filing the Income Tax return.

Last date to link PAN with Aadhaar

Earlier, CBDT extended PAN Aadhaar Linking from 31st Mar 2021 to 30th June 2021. As per the latest news, CBDT has further extended the last date to link Pan with Aadhaar from 30th June 2021 to 30th September 2021. Again, the last date to link PAN with Aadhar is 31st March 2022. Once again, the last date to link PAN with Aadhar is extended to 31st Mar 2023.

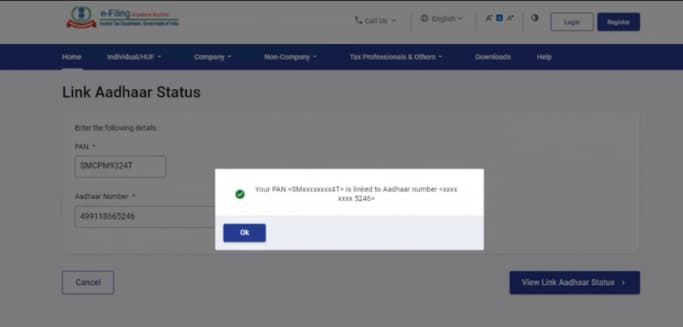

PAN Aadhar Link Status

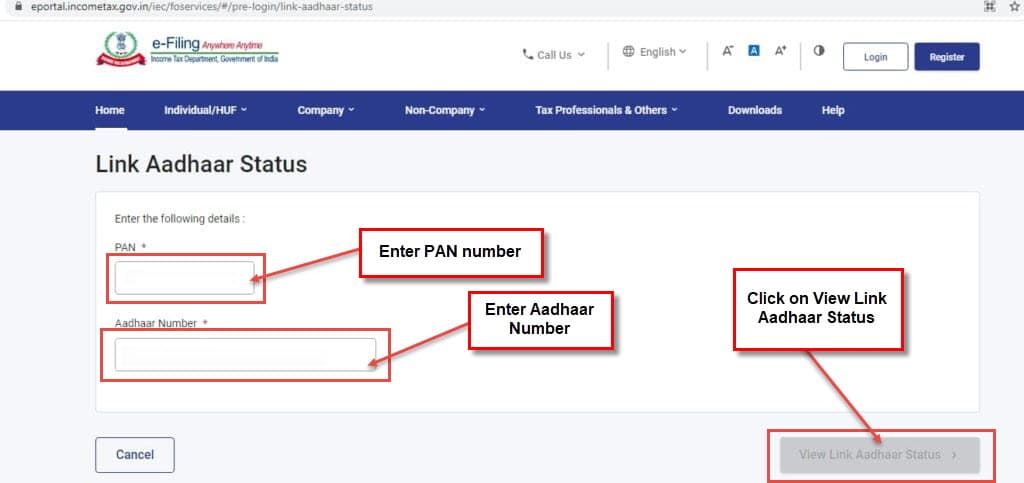

Here is how to check if PAN and Aadhaar is linked

- Go to the official income tax website https://www.incometax.gov.in/iec/foportal/

- Click on Link Aadhaar Status.

3. You will reach the below screen.

Enter your PAN number and Aadhaar Number and click on View Link Aadhaar Status to know the status.

4.On successful validation, a message will display your Link Aadhaar status.

Consequences for not linking PAN to Aadhar Number

The Central Board of Direct Taxes has notified Rule 114AAA prescribing the manner and consequences if PAN becomes inoperative. The Rule 114AAA(2) provides that where a person whose PAN has become inoperative, it shall be deemed that he has not furnished, intimated or quoted the PAN, as the case may be. He shall be liable for all the consequences under the Act for not furnishing, intimating or quoting the PAN.

How to Link PAN with Aadhaar if there is Name Mismatch?

Generally, your personal details such as Name, Gender and Date of Birth must match in both PAN card and Aadhaar card to make linking PAN card and Aadhaar card possible. However, if there is a mismatch you may have to do the necessary corrections before linking PAN with Aadhaar.

Let us see the 2 scenarios of mismatch and how to go about linking PAN and Aadhaar.

1.Minor mismatch

If there is a minor mismatch in Aadhaar name and the actual data in Aadhaar, you can change it using the Aadhaar Online Portal or Mobile Application. You need to pay fee of Rs 50 (including GST) to update any demographic information online.

Minor changes in the name include:

- Spelling corrections (example: Roy to Ray)

- Sequence change (example: Sishir Suman Mishra to Suman Sishir Mishra)

- Inclusion of space between name parts (example: BipinchandraVerma to Bipin Chandra Verma)

- Short form to full form (example: UP Singh to Umesh Prasad Singh)

- Change of surname after marriage (example: Neha Sharma to Neha Verma)

For minor changes, you will receive an OTP on your mobile number registered with Aadhaar for Aadhaar authentication. After the authentication, the changes will be made.

2.Complete Mismatch

If there is a complete mismatch of name in PAN and Aadhaar card, you will get a prompt to change the name in Aadhaar or in PAN database.

Biometric Aadhaar Authentication is required for Aadhaar linking in cases of Demographic Data mismatch in PAN and Aadhaar.

Download Aadhaar Seeding Request Form and visit designated PAN centre for Biometric Aadhaar Authentication.

Faqs

1. What is a PAN number?

The full form of PAN is the Permanent Account Number. PAN is a unique 10-digit alphanumeric identity allotted to each taxpayer by the Income Tax Department under the supervision of the CBDT.

2. How to check if my aadhaar and pan are linked?

You can check the status from the link Link Aadhaar Status.

3.Is it mandatory to link PAN to Aadhar?

To do any financial transactions PAN and Aadhaar must be linked. Otherwise, the PAN will become inoperable after the deadline.

4.What is the Aadhar PAN link last date?

The last date to link PAN to Aadhar is 30th June 2023.

5. What to do if I am unable to link PAN to Aadhar?

If you are unable to change the name neither in PAN nor in Aadhaar database, then you may visit the income tax official website or call IT department helpline.

6. What is the e-filing PAN Aadhaar link?

Below is the e-filing PAN Aadhaar link

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar

7.Who is exempt from linking PAN to Aadhar?

Linking PAN to Aadhar is not applicable to below individuals:

(a) Those residing in Assam, Jammu and Kashmir, and Meghalaya

(b) A person who is a non-resident as per the Income Tax Act, 1961

(c) A person who is 80 years and above at any time during the previous year

(d) An individual who is not a citizen of India.

8. Is PAN Aadhaar linking free?

For PAN is issued before 1st July 2017, you must pay fees of Rs 1000 to link PAN with Aadhaar if you are linking PAN and Aadhaar after 31st Mar 2023.

You are exempt from payment of fees for linking PAN with Aadhaar only if your PAN was issued on or after 31st July 2017.