Advance Tax Due Date for AY 2024-25 and for AY 2023-24 is listed below for easy reference. We will discuss what is advance tax, its applicability, Calculation of Advance tax instalment, challan details and how to pay online.

Income Tax

TDS Return Due Date – Filing Online – Status 2023

TDS Return Due Date is useful for both Government and other Deductors. You can easily keep track of the TDS due dates and file TDS return on time. In this article we will discuss what is TDS, who should file TDS return, frequency of filing of TDS return, TDS Return Due Date and TDS rates applicable.

Leave Encashment: Tax Exemption Increased to Rs 25 Lakhs

Leave Encashment tax exemption limit is increased to Rs 25 lakhs as per the latest CBDT notification.

The Central Board of Direct Taxes (CBDT) increases the tax exemption limit on leave encashment for non-government employees from Rs 3 lakhs to Rs 25 lakhs. The honourable Finance Minister Ms. Nirmala Sitharaman proposed the increase in tax exemption limit on leave encashment for non-government salaried employees in the Budget Speech 2023. The new tax exemption limit will come into effect from 1st April 2023.

80C Deduction for AY 2023-24: Maximize your Tax Savings!

80C Deduction is available to the Individuals and HUFs. The maximum allowable 80C deduction for FY 2022-23 is 1.5 lakhs. You can avail this deduction by investing in tax saving investments such as ELSS.

We shall discuss in detail the deductions under section 80C in the below article.

Section 80TTA – Claim Tax Deduction on Savings Account Interest

Section 80TTA provides a deduction of Rs 10,000 on interest earned on the Savings account. However, only individuals and HUFs can claim deduction under this section.

So, Senior citizens can claim deduction under section 80TTB, which has a higher deduction limit of Rs 50,000. Furthermore, you cannot claim an 80TTA deduction for interest earned on time deposits such as fixed deposits or recurring deposits.

Link PAN to Aadhar Easily

Link PAN to Aadhar by 30th June 2023 to continue your financial transactions. In other words, you will be able to buy or withdraw money only if you link PAN to Aadhar before the deadline.

Linking PAN with Aadhaar is a simple process. Yet, if you need help, check out How to link aadhaar with PAN card online step by step given below.

How to file Income Tax Return for Salaried Employee?

Learn how to file income tax return for Salaried Employee online. It is easy and you can file your ITR at the comfort of your home. Ensure that you file your return before the Income-tax due date to avoid any penalty.

If you are a salaried individual with an income of less than Rs 50 lakhs, you must use the ITR-1 form to file your income tax return. You can choose to file your ITR either online or offline.

80TTB Deduction for AY 2022-23

80TTB Deduction is a tax deduction given to senior citizens on the interest earned. The interest may be in the form of interest on a savings account or fixed deposits. The maximum amount of Deduction under section 80TTB is Rs 50,000.

Income Tax Return Filing Due Date 2021- Last Date Extended

CBDT further extends the income tax return filing due date (IT return due date) for FY 2020-21 from 31st Dec 2021 to 15th March 2022 for individuals whose accounts do not require an audit. This extension comes in light of the difficulties faced by taxpayers due to the COVID-19 pandemic.

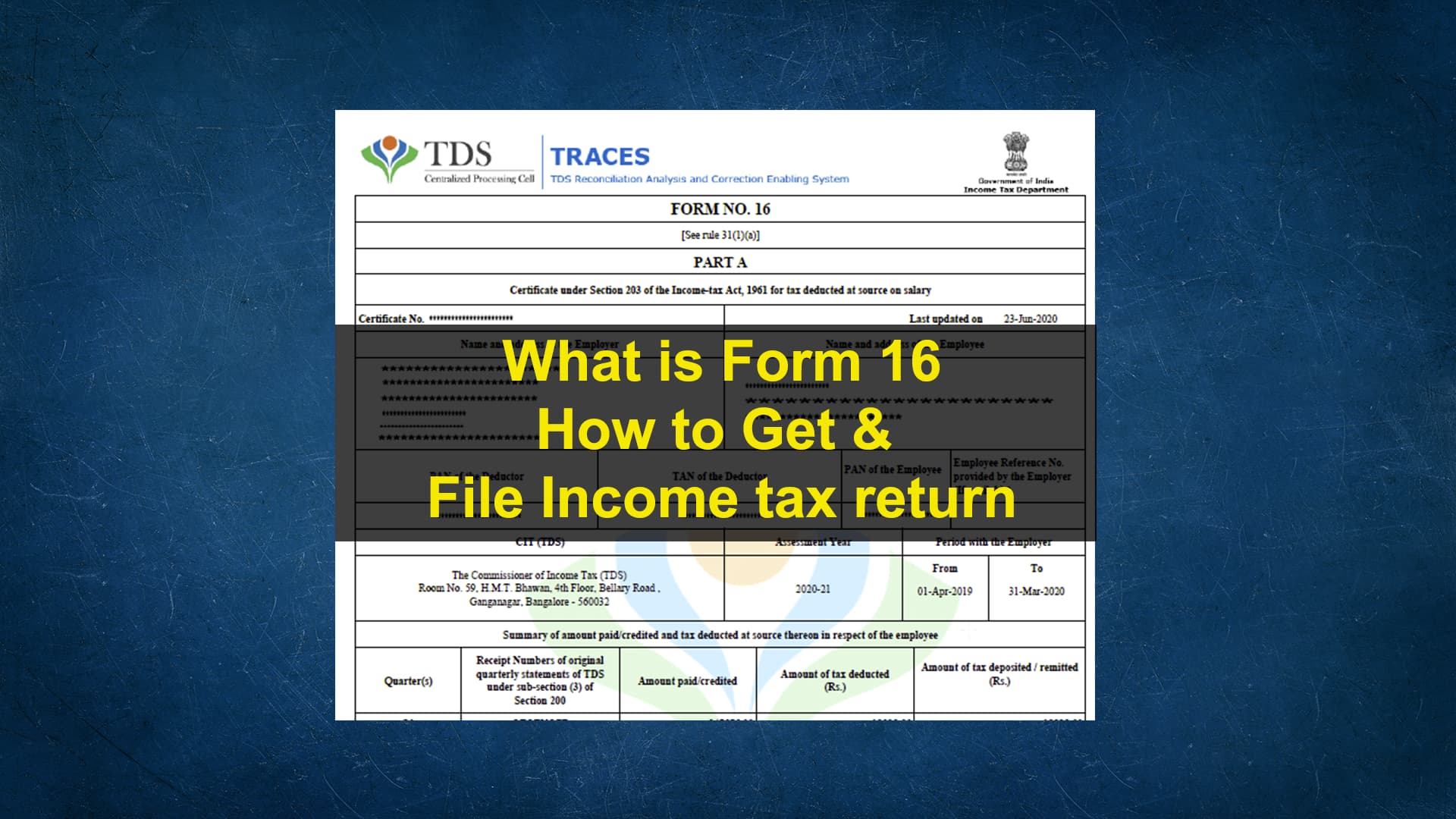

Form 16 – How to download and fill form 16?

Form 16 is a certificate of tax deduction at source. In simple words, it is proof of the tax deducted from your salary by your employer. As a taxpayer, you need form16 to file your income tax return for the financial year.

Also, it is mandatory for the employer to issue Form 16 under section 203 of the Income Tax Act, 1961. In this article, we will see what is Form 16, Eligibility salary, and how to get Form16 online.