Advance Tax Due Date for AY 2024-25 and for AY 2023-24 is listed below for easy reference. We will discuss what is advance tax, its applicability, Calculation of Advance tax instalment, challan details and how to pay online.

Table of Contents

What is Advance Tax?

Advance tax refers to the payment of your taxes in advance before the end of the financial year for the income earned in that financial year. The advance tax is to paid in four installments starting from June.

Advance Tax Applicability

Advance tax has to be paid in instalments by individual tax payers having income other than salary. Furthermore, the taxpayers who have opted for presumptive taxation under section 44AD or 44ADA must pay total advance tax before 15th March 2023.

You are required to pay advance tax only if

- You are a taxpayer having total tax liability of Rs 10,000 and above for the financial year 2022-23.

- The source of your income is other than Salary for the financial year.

Who is not Liable to pay Advance Tax?

A resident senior citizen who does not have any income from business or profession is not obligated to pay advance tax.

Advance Tax Due Dates AY 2024-25

Below is the advance tax slab for AY 2024-25 for individuals and corporate taxpayers.

| Installment | Advance Tax Due Date | Tax to be Paid |

| First Installment | 15th June 2023 | 15% of tax liability |

| Second Installment | 15th September 2023 | 45% of tax liability |

| Third Installment | 15th December 2023 | 75% of tax liability |

| Fourth Installment | 15th March 2024 | 100% of tax liability |

Advance Tax Due Dates AY 2023-24

| Installment | Advance Tax Due Date | Tax to be Paid |

| First Installment | 15th June 2022 | 15% of tax liability |

| Second Installment | 15th September 2022 | 45% of tax liability |

| Third Installment | 15th December 2022 | 75% of tax liability |

| Fourth Installment | 15th March 2023 | 100% of tax liability |

Advance Tax Calculation

Steps to calculate Advance Tax Installment

1. Estimate your income as accurately as possible for current financial year 2023-24 based on the income received to date, income yet to receive and also previous financial year.

2. Check the Income Tax Slabs and apply the tax rate applicable to you.

3. You will get your estimated total tax liability.

4. You need to pay your advance tax in four instalments:

First installment – Calculate 15% of your total tax liability and pay online using challan 280 within advance tax due date of 15th June 2023.

Second installment – Calculate 45% of your total tax liability and pay online within advance tax due date of 15th September 2023.

Third installment – Calculate 75% of your total tax liability and pay online within advance tax due date of 15th December 2023.

Fourth installment – Calculate 100% of your total tax liability and pay online within advance tax due date of 15th March 2024.

OR

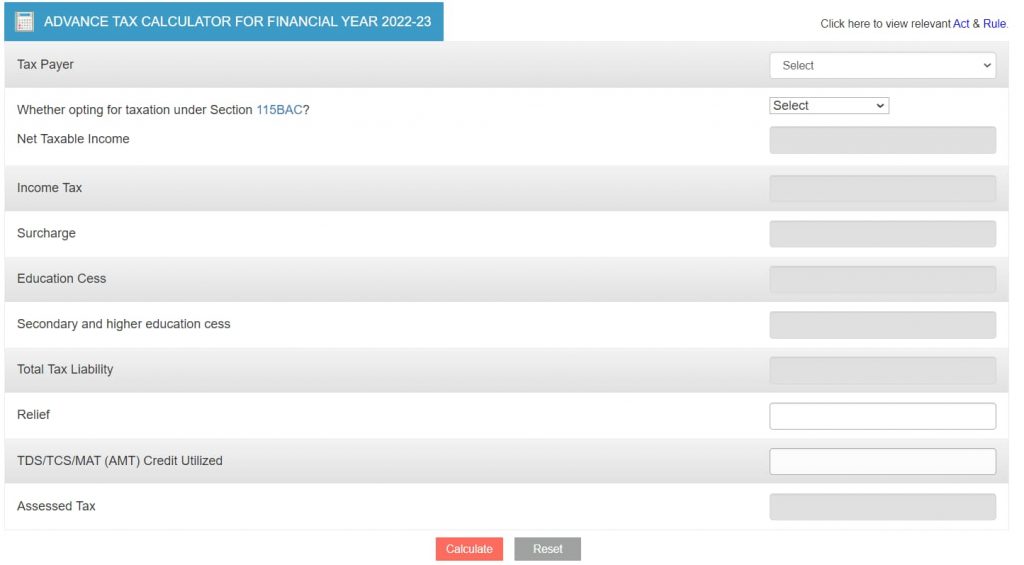

You can directly calculate advance tax installment using the Advance Tax Calculator.

How to calculate advance tax for AY 2024-25?

Let us understand how to calculate Advance Tax for AY 2024-25 with the help of an example.

Assuming that my estimated total income is Rs 7,00,000 for FY 2023-24.

| Particulars | Amount |

| Income from Salary | 7,00,000 |

| Less: Tax exempt/ relief | 5,00,000 |

| Gross Taxable Income | 2,00,000 |

| Applying applicable Tax rate @ 20% | 40,000 |

| Income Tax Liability [12,500+(tax@ 20%)] | 52,500 |

| Add: Health & Education cess @4% | 2,100 |

| Total Income Tax Payable | 54,600 |

So from above we know that the total tax to be paid for the financial year 2023-24 is RS 54,600. For the purpose of paying advance tax, we will be splitting the total estimated tax amount payable into 4 instalments.

| Advance Tax Installment | Installment Amount (in Rs) | Cumulative Amount (in Rs) |

| 1st Installment (15%) | 8,190 | 8,190 |

| 2nd Installment (45%) | 16,380 | 24,570 |

| 3rd Installment (75%) | 16,380 | 40,950 |

| 4th Installment (100%) | 13,650 | 54,600 |

| Total | 54,600 |

You may also use the Advance Tax Calculator available to calculate your Advance tax accurately.

Advance Tax Payment Mode

Different payment modes are given based on category of taxpayer.

Corporate taxpayer: Online through Internet banking facility

Taxpayer other than company whose accounts are to be audited: Online through Internet banking facility

Other Taxpayer: Online or Offline.

How to Pay Advance Tax for AY 2024-25?

You may pay your advance tax either online or offline.

Below are the step by step procedure to pay advance tax online:

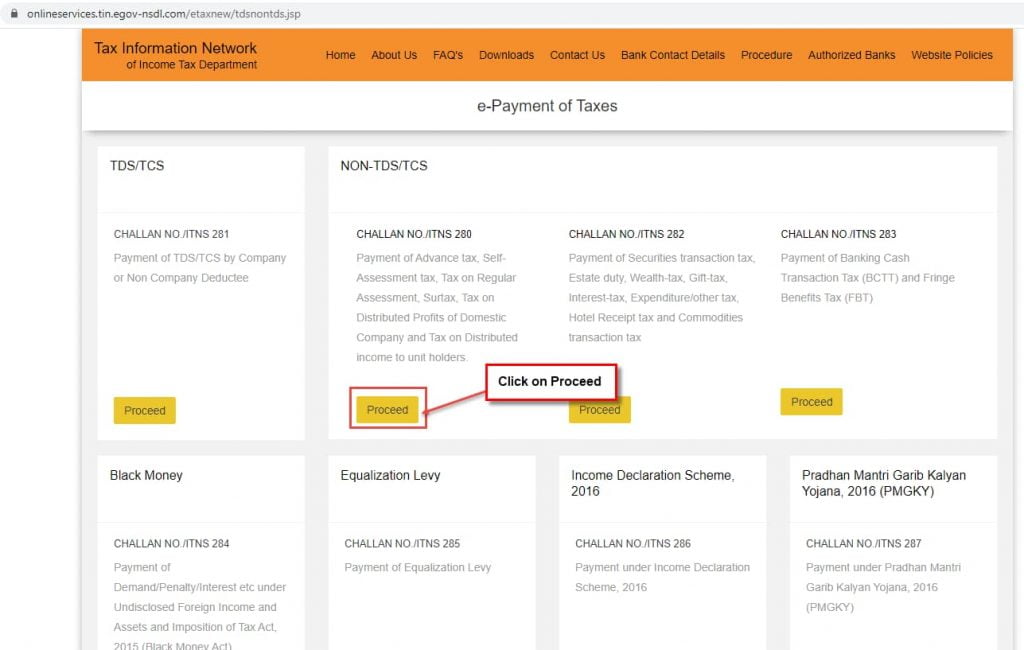

1.Go to https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

2.You will see the e-payment of taxes page. Click on ‘Proceed’ under challan no/ ITNS 280.

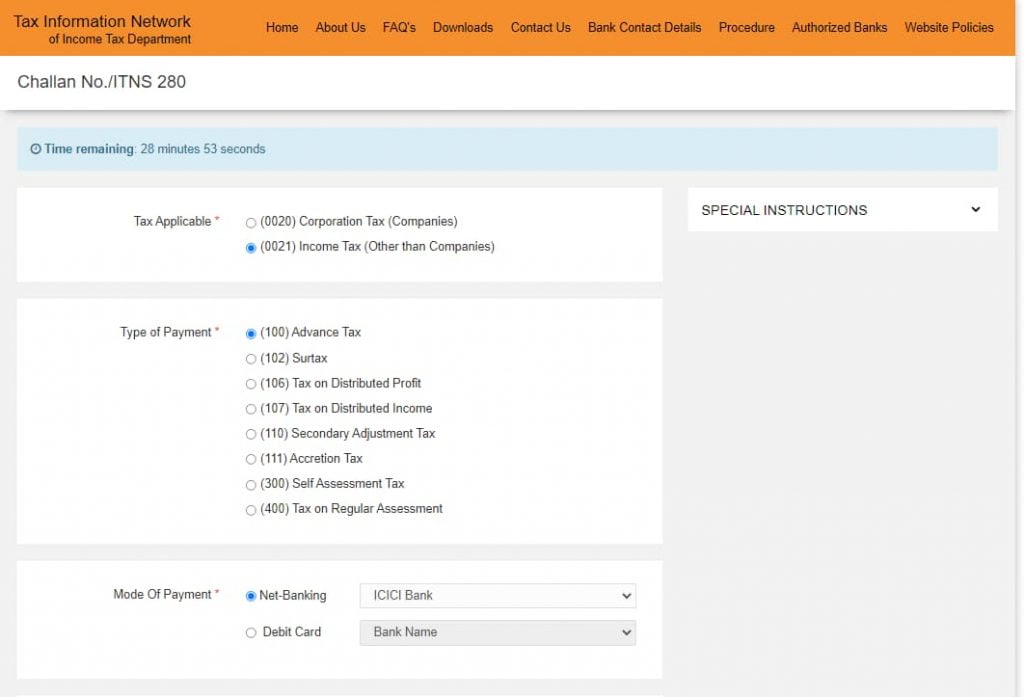

3. In the below screen,

Tax Applicable: Select Income tax (other than companies)

Type of Payment : (100) Advance tax

Mode of payment: Select any mode as per your preference.

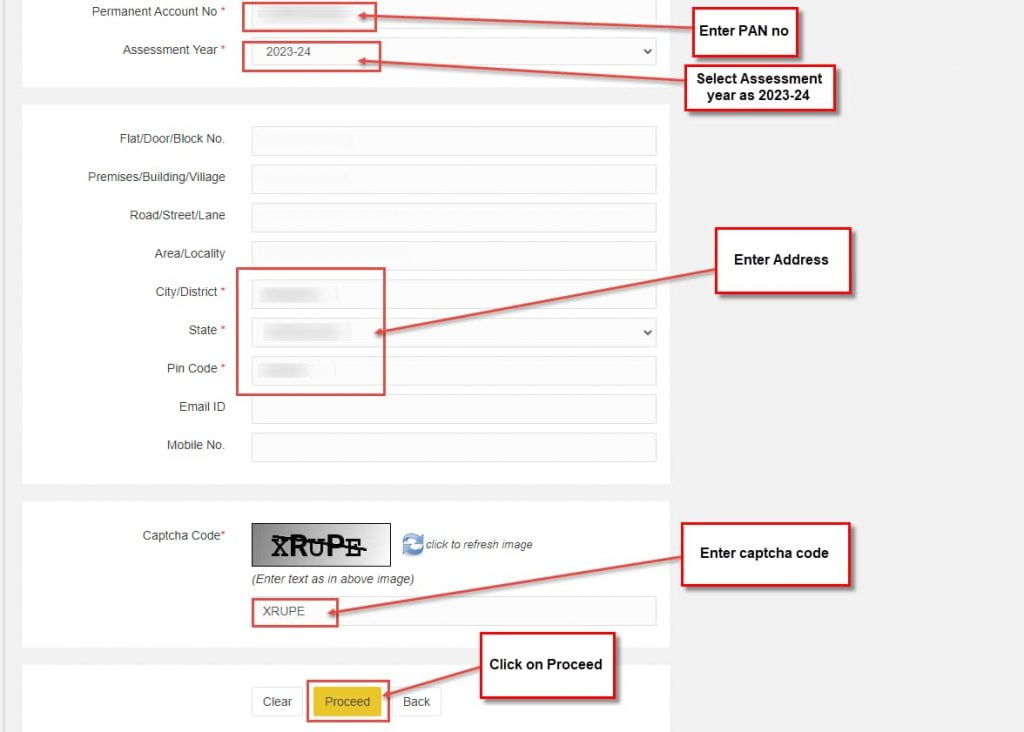

4.In continuation to the form, enter your PAN, Select assessment year as 2023-24, enter your address and captcha as shown in the below screen. Click on Proceed.

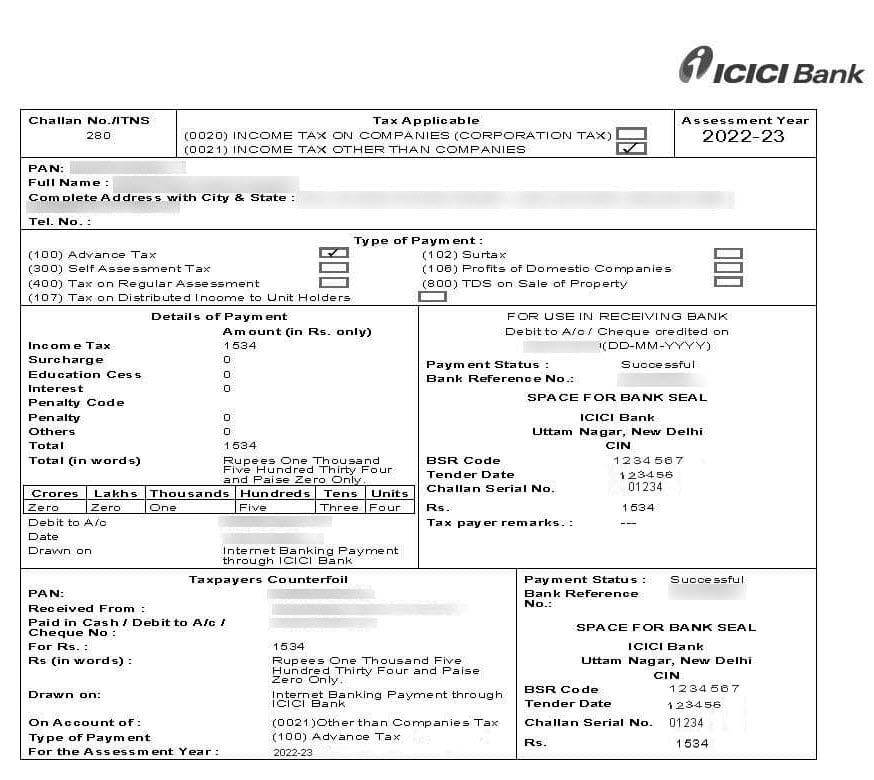

5. Once the payment is successful, the portal will generate a challan as below. You must note down the BSR Code and the tender date so that you can mention the same while you are filing your income tax return.

The below challan is the proof of advance tax paid.

Interest on Advance Tax Calculation

If you do not pay the advance tax instalment before the advance tax due date or pay lower tax, you will have to pay interest as penalty under section 243C. However, interest will not be charged if you have paid the advance tax instalments in full by the end of the financial year. Furthermore, if you have failed to accurately estimate your income from lottery, capital gains, you need not pay any interest. Interest rates calculation vary for Corporate and Non-Corporate Taxpayers.

Interest for Corporate Taxpayers

| Advance tax paid | Interest |

| Less than 12% of the total tax liability before 12th June | 1% per month for 3 months |

| Less than 36% of the total tax liability before 15th September | 1% per month for 3 months |

| Less than 75% of the total tax liability before 15th December | 1% per month for 3 months |

| Less than 100% of the total tax liability before 15th March | Simple interest of 1% |

Interest for Non-Corporate Taxpayers

| Advance tax paid | Interest |

| Less than 30% of the total tax liability before 15th September | 1% per month for 3 months |

| Less than 60% of the total tax liability before 15th December | 1% per month for 3 months |

| Less than 100% of the total tax liability before 15th March | Simple interest of 1% |

Payment of Advance Tax on Receipt of Income tax Assessment Order

(1) Income tax assessment Order under section 210(3)

You may receive Income tax notice under section 210(3) if you fail to your advance tax within the due date or the advance tax amount paid by you is lower than the actual tax for the financial year and the regular assessment is also completed. The assessing officer can send this order latest by the last day of February.

Reply to the Income tax notice

(a) If your estimate is lower than the assessing officer’s estimate you can submit your own estimate of current income/ advance tax in form 28A.

(b) If your estimate is higher than the assessing officer’s estimate you may pay the higher advance tax and no initiation is to be sent to the assessing officer.

Advance Tax Due Dates Faqs

(1) Who must pay Advance Tax?

Any individual taxpayer who has source of income from sources other than salary must pay advance tax.

(2) Are Salaried individuals exempt from paying Advance tax?

TDS is deducted from the salary every month so the salaried individuals are not required to pay any advance tax.

(3) If I pay the taxes on 31st March 2024, will it be considered as advance tax?

If you pay any tax till 31st March 2024, it will be considered as advance tax.

(4) What to do if there is a change in the tax liability after making the initial 3 advance tax instalments?

You can revise your estimates and pay revised advance tax.

(5) Are there any deductions allowed while computing advance tax?

Advance tax liability is computed after providing

– For relief of tax under section 90 or 90A

– Any deduction under section 91

– Any tax credit allowed to be set off as per section 115JAA or 115JD

(6) What if I fail to pay the advance tax?

If you fail to pay the advance tax or the advance tax amount paid by you is less than the required tax amount, the Assessing officer may pass an order under section 210 (3) requiring you to pay the remaining advance tax. Furthermore, you may be obligated to pay interest under section 234B.

(7) What is the last date for Advance tax for FY 2023-24?

The Advance Tax due date for FY 2023-24 is 15th March 2024.

(8) Is the Advance Tax due date extended for Ay 2024-25?

No, there is no extension in the Advance tax due date for AY 2024-25.

(9) Who are exempted from paying advance tax?

Senior citizens who do not have income chargeable to tax under the head ” profits and gains of business or profession are exempt from advance tax.

(10) Who is not liable to pay advance tax?

Below persons are not liable to pay advance tax:

a. An individual whose tax liability for a year is less than Rs 10,000

b. Senior citizens who are above 60 years of age.

c. Salaried employees who do not have any other source of income

(11) Where does the advance tax payment made reflect?

The advance tax payment made by you will reflect the form 26AS under “Part C-Details of Tax Paid (other than TDS or TCS).

(12) Which form is used to make the Advance tax payment?

Challan 280 is used to make the advance tax payment.

In a nutshell, you should be aware of the Advance Tax Due date and the method of interest calculation so that you can avoid payment of huge interest charges. Being a smart taxpayer helps manage your finance better.