Table of Contents

What is DIN number?

Director Identification Number or DIN is a unique eight-digit number provided by the central government to the director of a company or the individuals who intend to be the company’s director. Each director will have a unique DIN. And DIN has lifetime validity. You can have only one DIN and be the Director of two or more companies. In this article, we shall see how to get DIN number, Importance of Director Identification Number, check your DIN status , and more.

Importance of Director Identification Number

1.DIN number uniquely identifies a Director.

2.The Government maintains a DIN Holders’ database with all the details of the Director.

3.The Government uses the DIN to avoid fraud and verify the valid identity of the Directors.

4.You require DIN to sign any e-form on MCA as a director.

How to Get DIN Number ( Director Identification Number)?

If you are a director of a company or desire to become a director, you can get DIN number by submitting the specific eform in the MCA portal.

Forms for DIN Application

Below are the different forms to apply for Director Identification Number or DIN. Choose the one that is suitable for you.

(1)SPICe Form: If you are to become the first director of a new company, this is the form you must use to apply for DIN.

(2)DIR-3 Form: If you want to become a director of an existing company, this the form you need to use to apply for DIN.

(3)DIR-6 Form: If you need to make any changes in the particulars of the directors, this is the form you should use.

1. SPICe Form:

If you are to become the first director in a new company, you can apply for DIN by submitting the SPICe form. Ensure that you attach the proof of Identity and address along with the application. MCA will allocate the DIN on approval of the eform.

2. DIR-3 Form:

If you want to become a director of an existing company, you can apply for DIN through eform DIR-3. As per Section 153 of the Companies Act, 2014 & Rule 9(1) of the Companies (Appointment and Qualification Of Directors) Rules, 2014 and Rule 10 of Limited Liability Partnership Rules,2009, filing of eform DIR-3 is mandatory every year for all the directors.

Overview of filing eform DIR-3

1.Register yourself at the MCA portal as a Business User.

2.Navigate to MCA Services>Company Forms Download & download the eform DIR-3.

3.Fill in your personal details in DIR-3 form.

4.Attach your passport size photo, proof of identity, and proof of residence.

5.Verify the documents by signing using your DSC.

6.Again, get it digitally signed by either Company Secretary in full-time employment of the company Director or Manager or CEO.

7.Upload the signed e-form DIR-3 on MCA portal.

8.Pay the fees online.

9.The system automatically generates the DIN number.

Now that we know few details about DIR-3. We shall see how to file the eform DIR-3.

How to File DIR-3 KYC (Step by Step Process)?

Firstly, we need to create an account in MCA portal to file DIR-3. Below are the steps to create an account in MCA Portal:

Creating an account in MCA Portal

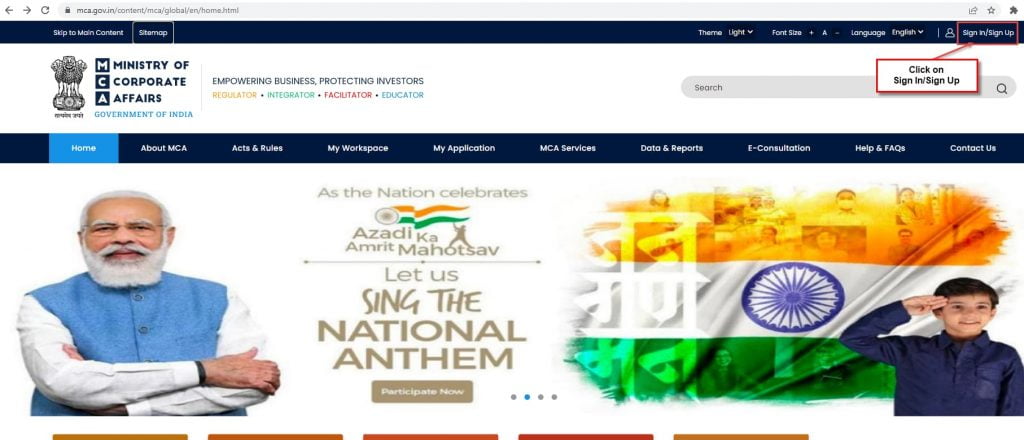

(1) Go to the MCA official page https://www.mca.gov.in/content/mca/global/en/home.html and click on Sign In/ Sign Up at the top right hand corner.

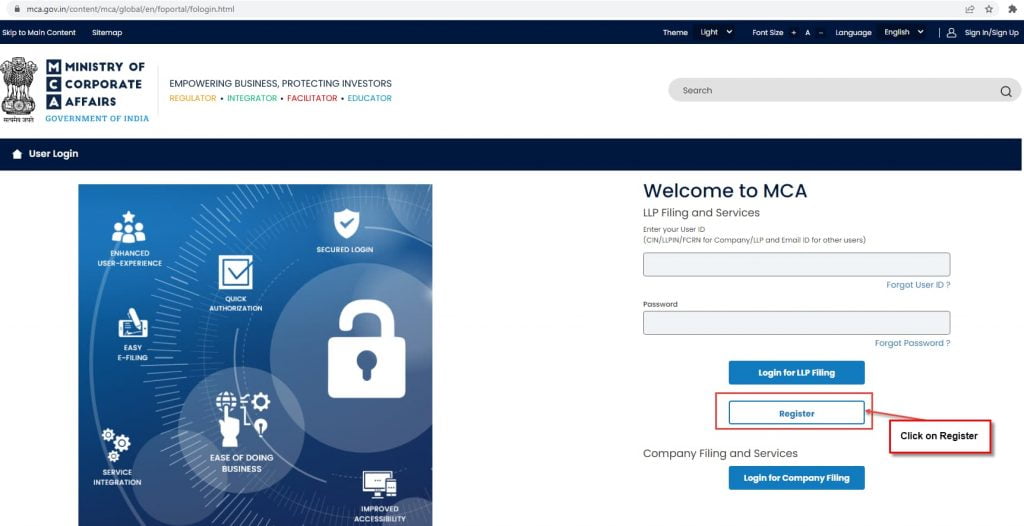

(2) You will reach the below screen. Click on Register to start the registration process. Registering yourself on the MCA portal is necessary to access basic functionalities.

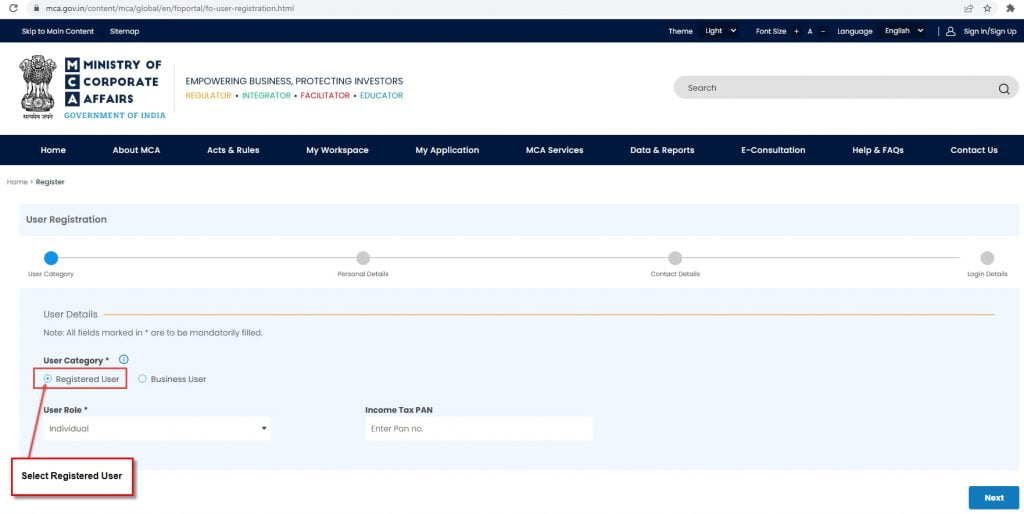

(3) When you click on register, you will reach the below screen. You can register either as a Registered User or a Business User. Initially we will register as Registered User as we are yet to obtain DIN. In the below screen, select Registered User. User Role is automatically selected as Individual. Income Tax PAN is not mandatory for Registered User. Click on Next.

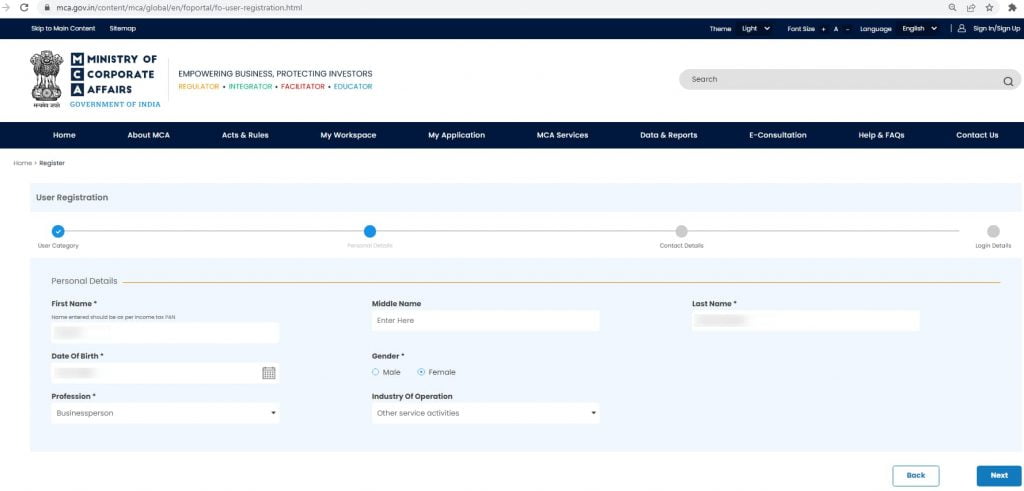

(4) User Registration Personal Details

In the below screen, enter your First name, Last Name, Date of Birth, Gender and Profession. Click on Next.

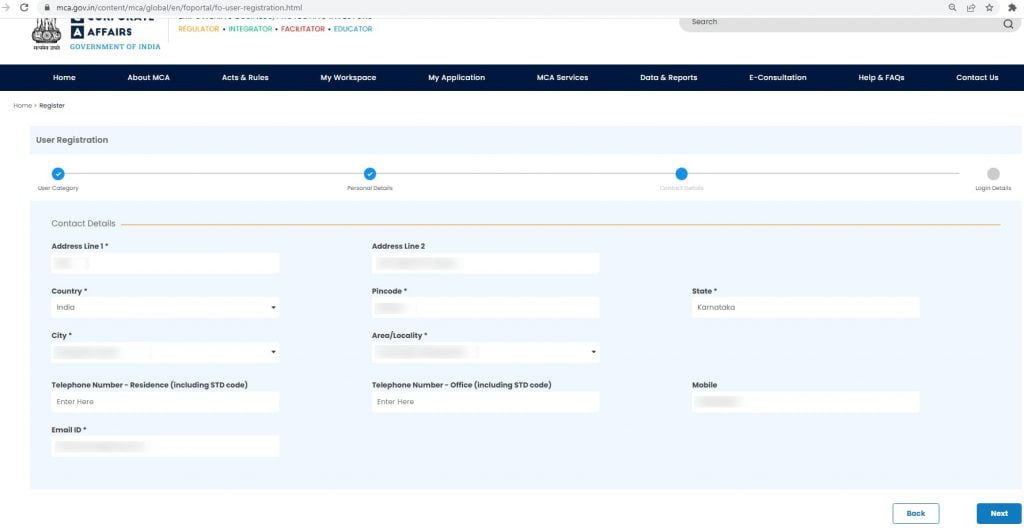

(5) Contact Details

In the below screen, enter your Address in the respective fields, email id and Mobile number. Mobile number is not mandatory but it is suggested to enter the mobile number to get OTP as there is some problem in getting OTP to your registered email id. Click on Next.

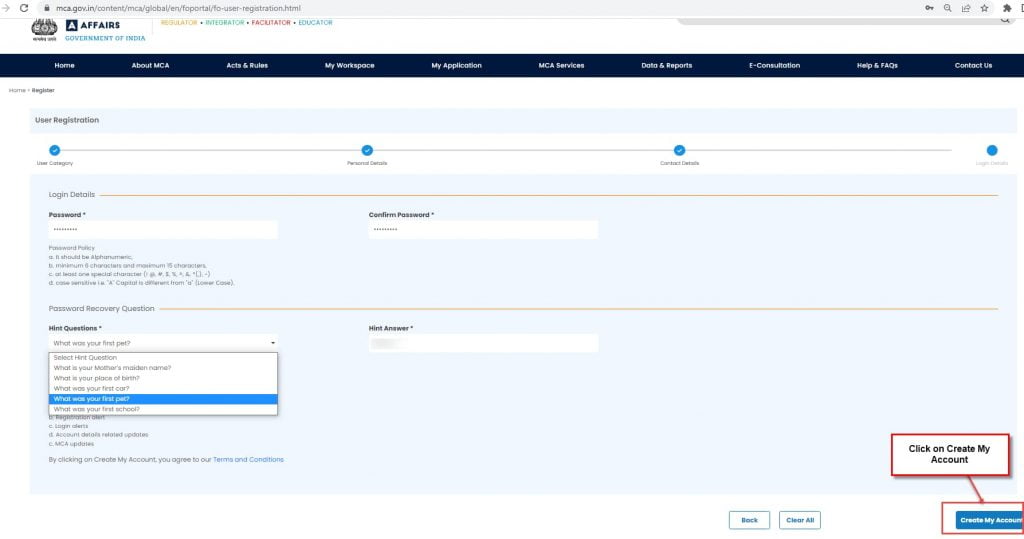

(6) Login Details

Enter password (min 6 characters alphanumeric, atleast 1 special character), Select Hint question and Hint Answer. Click on “Create my account”.

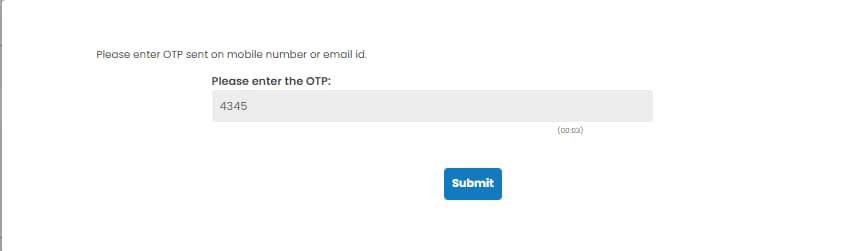

(7)An OTP will be sent your registered mobile number. Enter the OTP and click Submit.

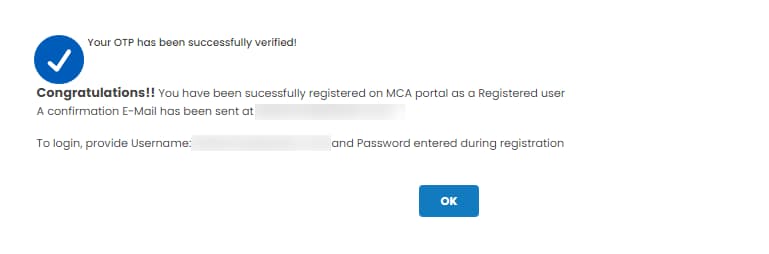

(8)You will get the below message on successfully registering yourself on MCA portal.

Note:

A Registered User has access to the basic e-Services of MCA. All users under this category have a ‘Password’ based login.

A Business User has access to certain specific functionalities and all the basic e-Services of MCA available to a Registered User. Users under this category primarily have a ‘DSC’ based login and consist of practising members of ICSI/ICAI/ICWAI and individuals associated with companies.

Applying for DIN

(1)Now that you have created your account. Login to the MCA portal with your username and password.

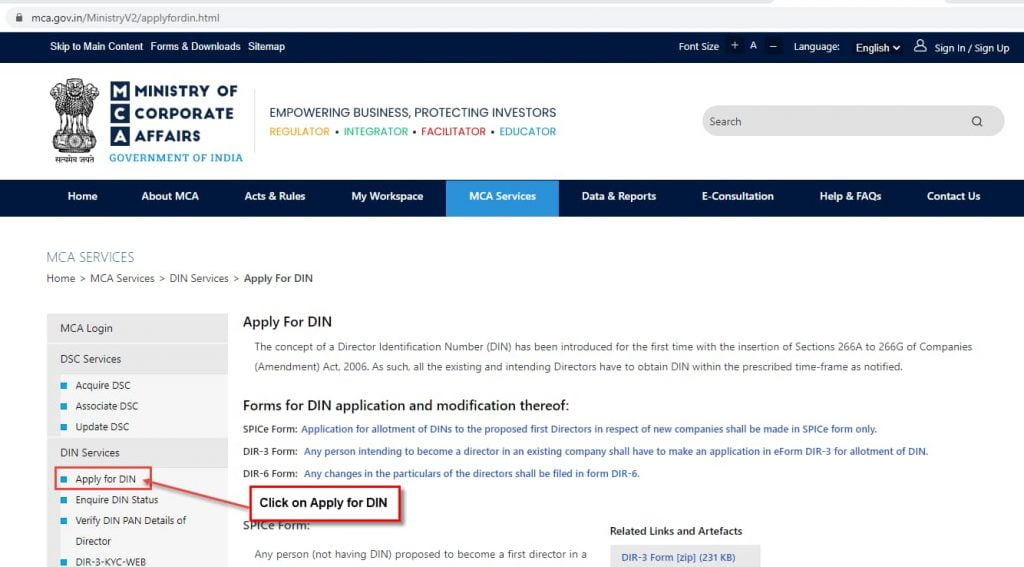

(2)Go to Home > MCA Services > DIN Services > Apply for DIN to download the DIR-3 form.

or

Home > MCA Services > E-Filing > Company Forms Downloads

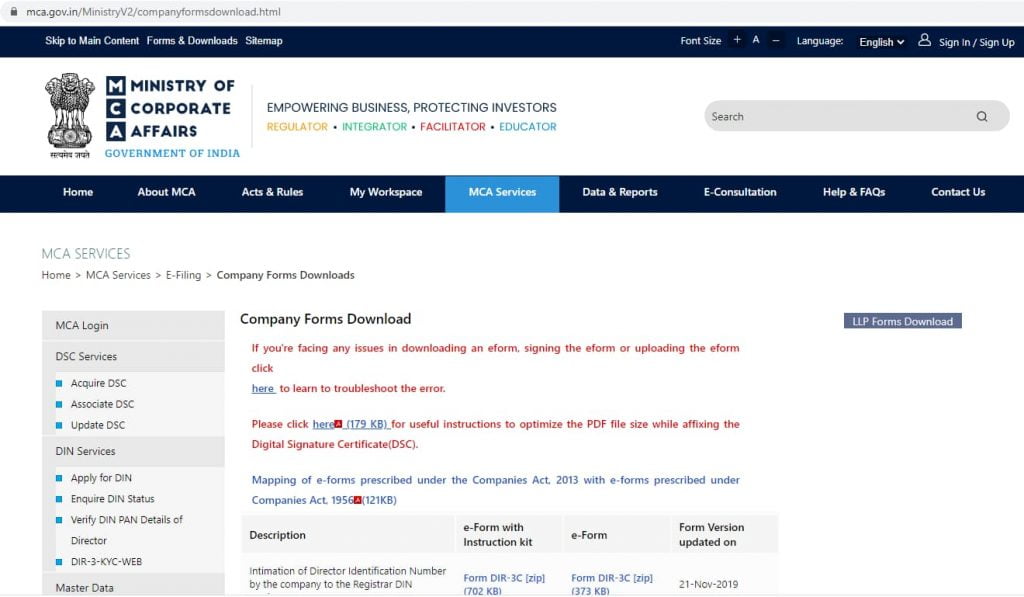

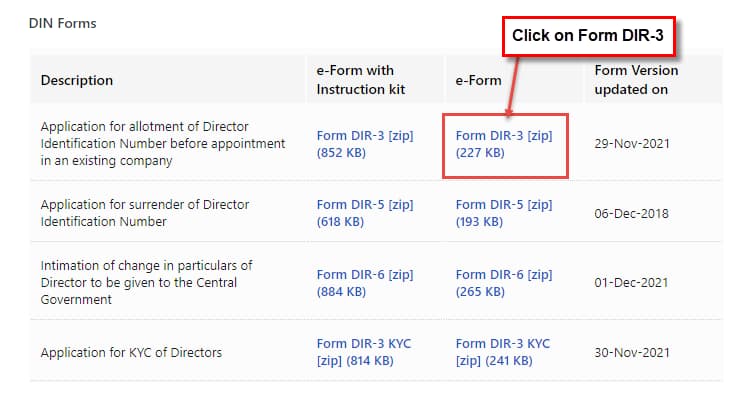

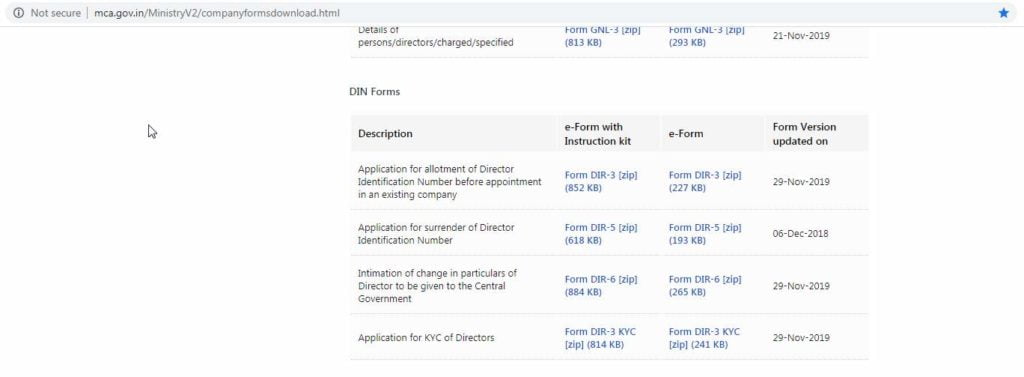

Once you are on the Company Forms Download page, scroll down to DIN forms & download the eform DIR-3.

(3)Click on Company Forms Download and you will reach the below screen

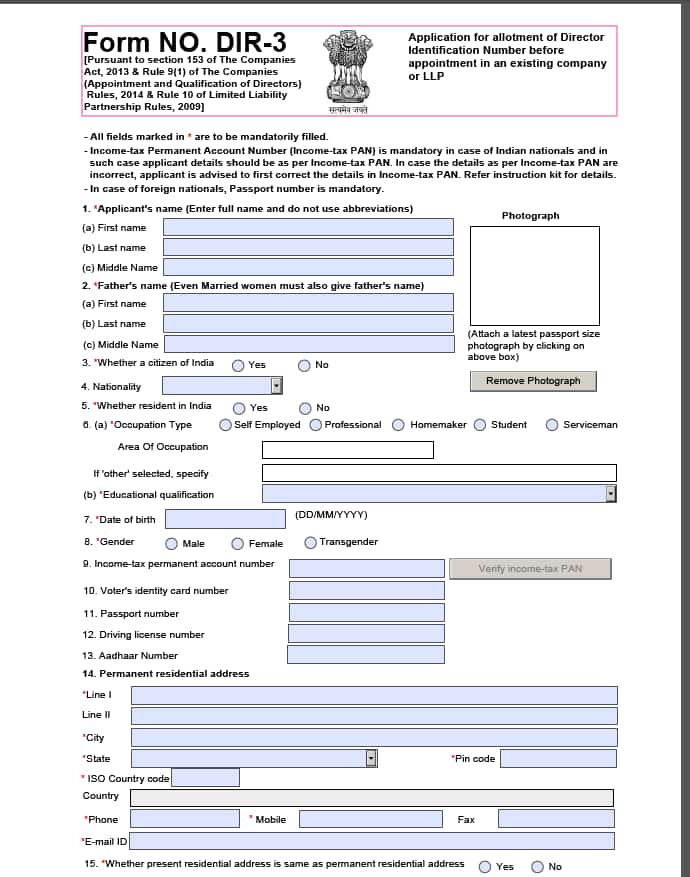

(4) How to fill form DIR-3

Now click on Form DIR-3 & fill in all the details in the below form. Also, attach your photo in the box given.

eForm DIR -3 Page 1

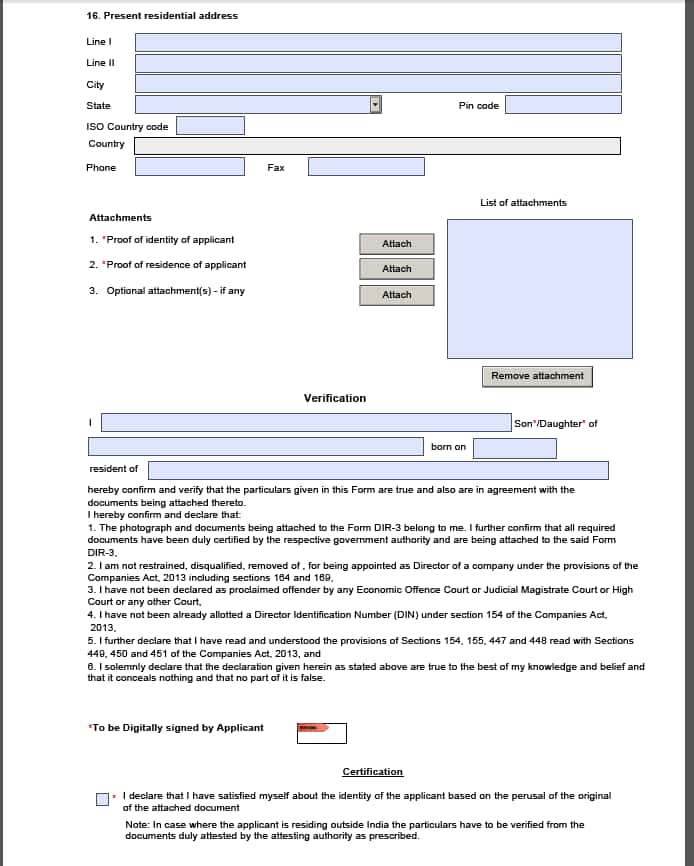

eForm DIR -3 Page 2

Supporting Documents:

Here attach the photograph and scanned copy of supporting documents. i.e. proof of identity, and proof of residence as per the guidelines. You need not submit any documents at DIN cell. Also it is mandatory that you verify and sign the form digitally.

Verify the documents by signing them digitally.

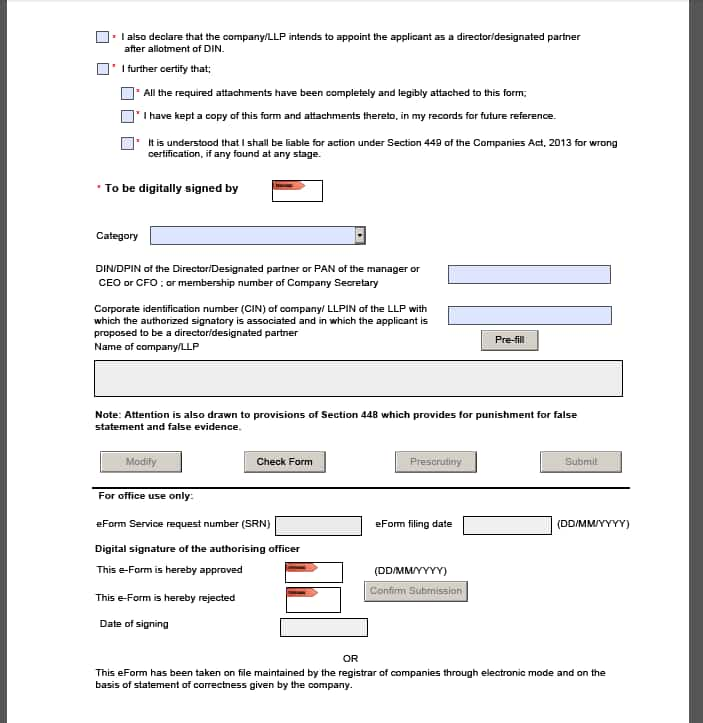

eForm DIR -3 Page 3

The DIR-3 eform must be verified and digitally signed by either Company Secretary in full time employment of the company Director or or Manager or CEO or CFO of the existing company in which the applicant is intended to be appointed as a director or Designated partner.

(5)DIR-3 eForm Upload:

Once you have filled the form DIR-3, go to the MCA21 portal and click on the ‘eForm upload’ link available under the ‘eForms’ tab for uploading the eForm DIR- 3.

(6)Fee Payment:

Upon upload, make the payment of the filing fee of Rs 500 for eForm DIR-3. Only electronic payment of the fees shall be allowed (i.e. Net banking / Credit Card/Debit Card/Pay later/ Neft).

(7)Generation of DIN:

Upon upload and successful payment, if Form DIR-3 details have not been identified as a potential duplicate, the system will generate an approved DIN. And if the details have been identified as a potential duplicate, Provisional DIN shall be generated.

(8)Verification of e Form:

In case details of eForm DIR-3 are found as potential duplicate, the same gets routed to the DIN cell for back-office processing. Upon approval of the form, the provisional Director Identification Number (DIN) becomes approved DIN and would be available for further use.

You can check your DIN status anytime at the MCA portal.

DIN Status Check

Below are the steps to do check your DIN status.

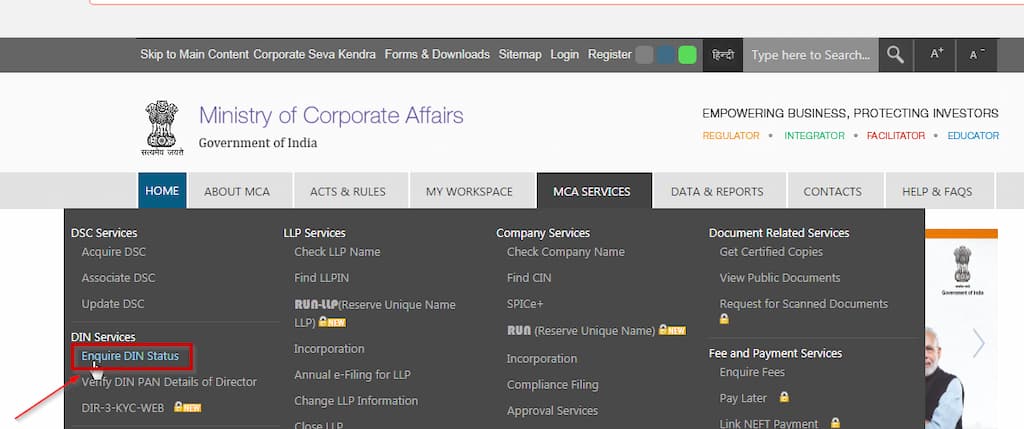

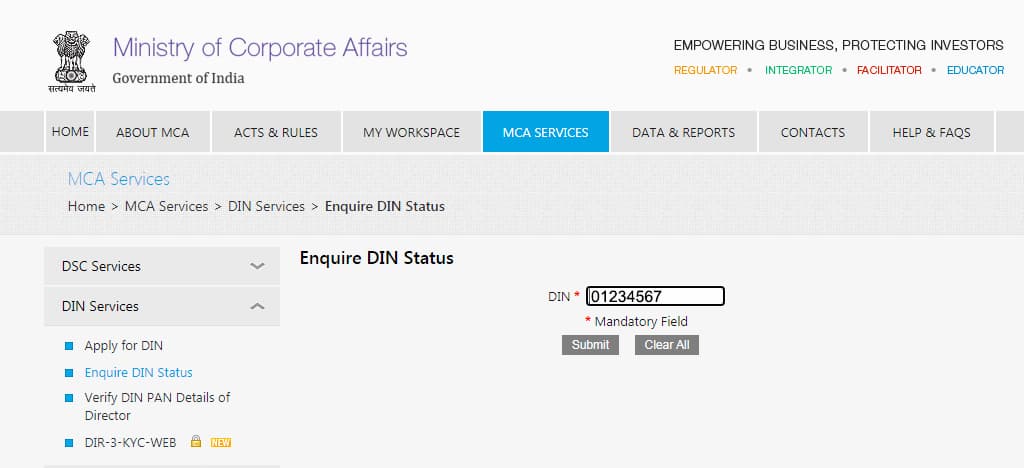

(1) Go to https://mca.gov.in/

(2) Under MCA Services tab click on Enquire DIN Status.

(3)Enter the DIN number and click on submit. It displays the details of the director.

Knowing DIN Status is one thing; however, what if you want to verify the DIN number or find the DIN number of a director and you do not have any details other than the company name. Well, there is a way to check the DIN number.

DIN Number Check/ Find DIN Number of Director

Know how to check DIN number of a Director by following the below steps:

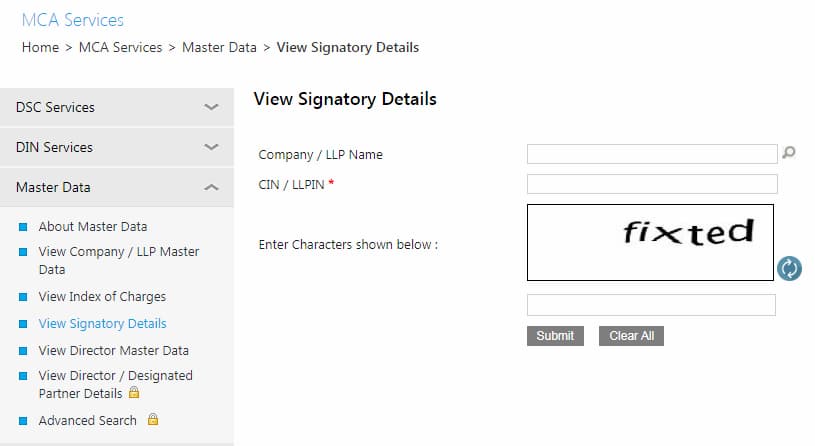

1.Go to the official MCA website.

2.Navigate from Home>MCA Services> Master Data> View Signatory Details.

3. Click on the search icon corresponding to the Company name and enter the company name to find the CIN of the company.

4. Now, input the CIN and the captcha. Click on submit.

5. You will find DIN number of director.

MCA approves a provisional DIN after scrutiny of the documents attached with the application. Sometimes, it so happens that MCA rejects your DIN. Fortunately, you can reapply once you correct the reason for rejection. We will see common causes of rejecting DIN.

DIN Number Search

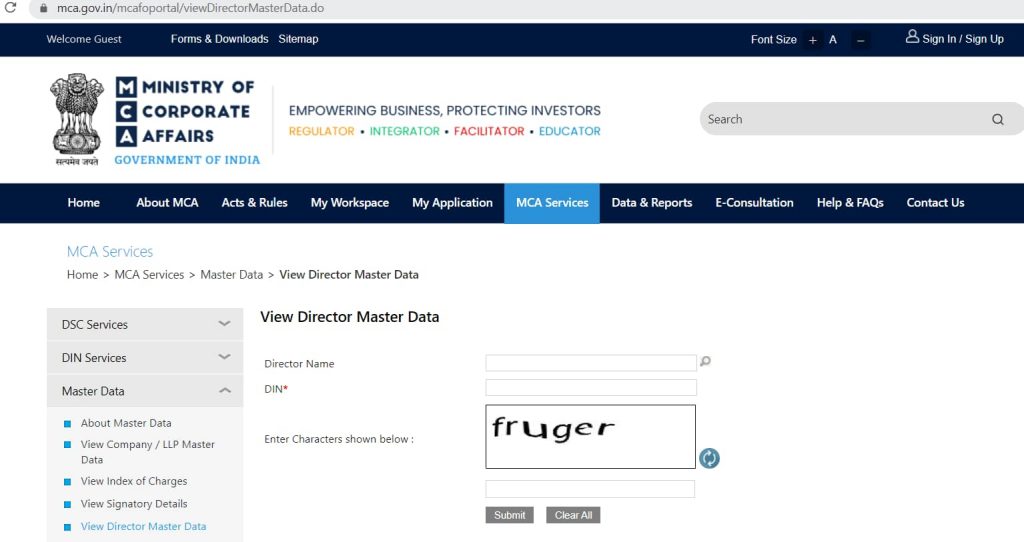

You can do DIN Number Search by Name by following the below steps:

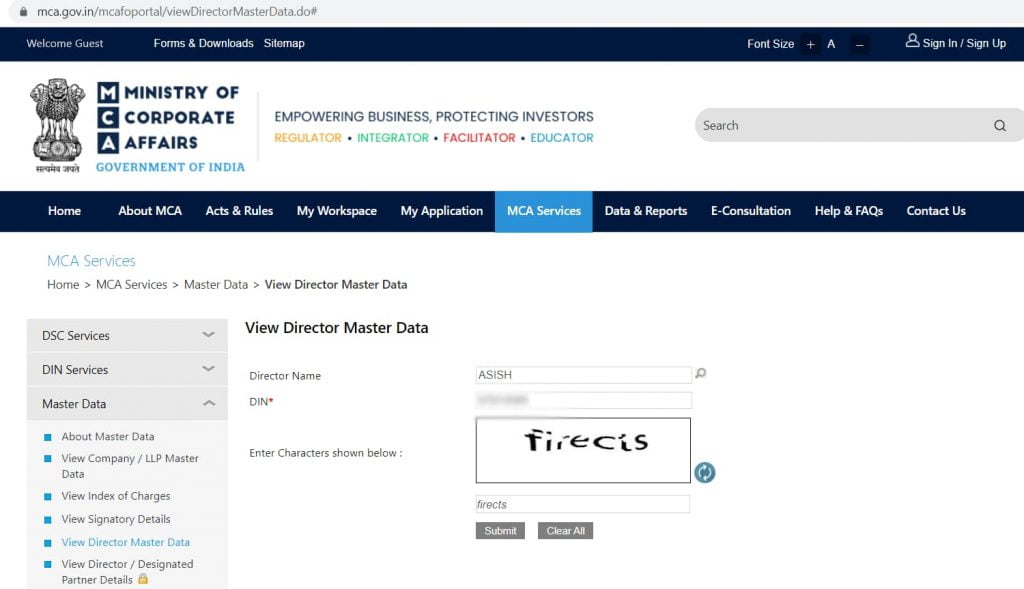

1. Go to the MCA website.

2.From the home screen go to MCA Services>Master Data>View Directors Master Data.

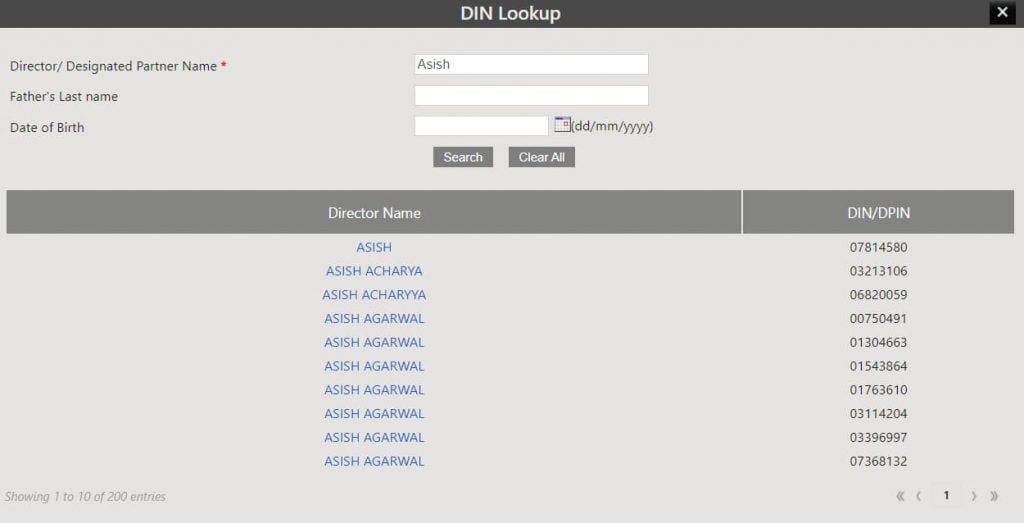

3. You will get the below screen. Enter the name of the Director and click on Search.

4. Once you hit Enter, you will get a list of directors with the name provided by you.

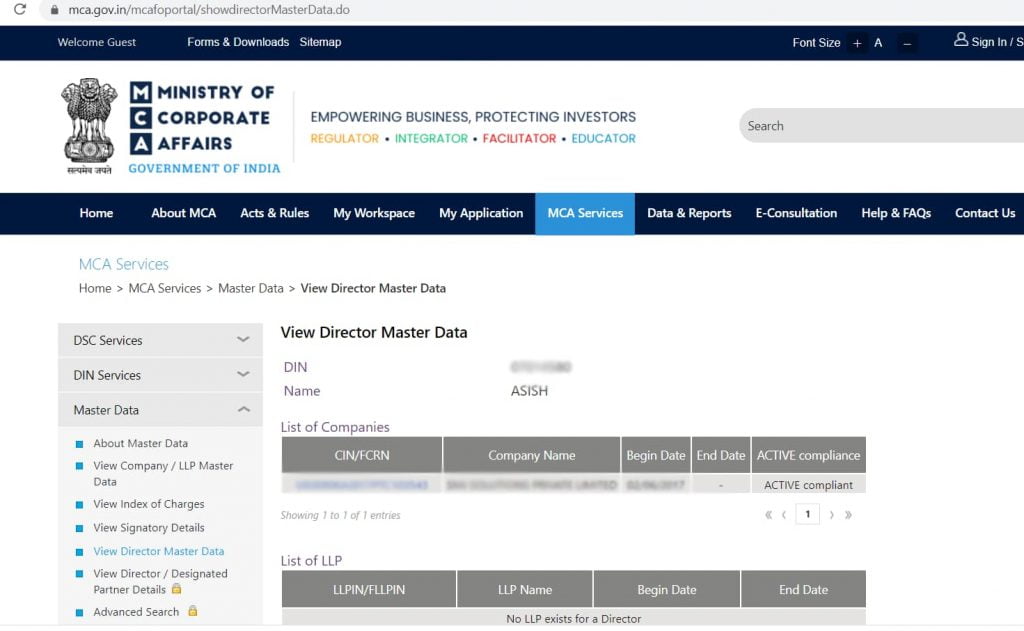

5. Click on the name of the director that you want to know the details on and enter the captcha code and click on submit.

6. You will get the director details such as the list of companies in which he is director, Company name, Begin date as a Director, End date, ACTIVE Compliant or not.

What if my DIN application is rejected?

Common Causes of Rejection of DIN Application:

Non-submission of supporting documents

The applicant does not submit

(1) Proof of identity.

(2)Proof of father’s name.

(3)Proof of date of birth.

(4)Proof of residential address.

(5)The copy of passport (for foreign nationals).

Invalid Application/supporting Documents

•The supporting documents are invalid or expired.

•The proof of identity submitted has not been issued by a Government Agency.

•The application/enclosed evidence has handwritten entries.

•The submitted application is a duplicate DIN application and already one application of that applicant is pending or approved.

•The submitted application does not have a photograph affixed.

•The signatures are not appended to the prescribed place.

•The applicant’s name filled in the application form does not match with the name in the enclosed evidence.

•The applicant’s father’s name filled in the application form does not match the father’s name in the enclosed evidence.

•The applicant’s date (DD/MM/YY) of birth filled in the application form does not match with the date of birth in the enclosed evidence.

•The address details filled in the application do not match those contained in the enclosed supporting evidence.

•The gender is not entered correctly in Form DIR-3.

•Identification number entered in the application does not match with the identity proof enclosed.

•If enclosed documents are not self-attested.

What to do if I need to do some changes in my Director Details?

If there is any change in the particulars submitted in form DIR-3/SPICe concerning Directors, you can submit e-form DIR-6.

For instance, in the event of a change of address of a director, he/she is required to intimate this change by submitting e-form DIR-6 along with the required attested document.

You must digitally sign the e-Form DIR-6 and further get it certified by a Chartered Accountant or a Company Secretary or a Cost Accountant in whole-time practice or company secretary (member of ICSI)/Director of an existing company in which you are a prospective director.

DIR 3 KYC Due date for FY 2021-22

Every year the director of the companies must complete the DIR 3 KYC or Director KYC by filing form DIR 3 before 30th April of the financial year for the DIN to remain active. DIR-KYC Due Date for FY 2022-23 is 30th September 2023.

DIR-3 KYC Fees

| Form DIR-3 KYC filed within the due date | No Fees |

| Form DIR-3 KYC filed after the due date. | Rs 5,000 |

Deactivation of DIN

The government will deactivate your DIN:

- You do not file the e-form DIR-3 KYC within the due date every year.

2. Your company is marked as “ACTIVE Non-compliant” due to non-filing of e-form “ACTIVE” or INC-22A.

How to Re-activate DIN?

You can get your DIN re-activated by filing the e-form DIR-3 KYC and paying fees of Rs 5000. This holds true only if your DIN is deactivated due to the Non-filing of DIR-3 KYC. However, if your DIN is deactivated because your company is marked as ACTIVE Non-Compliant then you must ensure that the company files eform INC-22A to get your DIN re-activated.

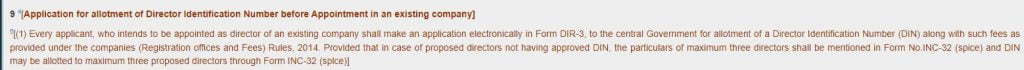

Director Identification Number in Company Law

Extract of Sec 153 of Companies Act ,2014 & Rule 9(1) of the Companies Rules, 2014

Section 153:

Rule 9(1):

Rule 9(3) (a ) and (b)

Director Identification Number Faqs

(1) What is DIN number?

DIN full form is Director Identification Number. It is a unique number given to the new directors of a company.

(2)How can I check my DIN status?

Visit MCA Portal and go to MCA Services>DIN Services>Enquire DIN Status to check your DIN status.

(3)How to know if my DIN is active or not?

If you find the DIN status as Approved, it means your DIN is active.

(4) How to find DIN number of Director/ DIN number check?

You can find the DIN number of the Director and other details such as Full name, Designation, Whether DSC registered, Expiry date of DSC, and Surrendered DIN by navigating the MCA portal>MCA Sevices> Master Data>View Signatory Details.

(5)Is there any Act regarding DIN?

With the insertion of Sections 266A to 266G of Companies (Amendment) Act, 2006, a Director Identification Number (DIN) concept has come into existence for the first time. All the existing and intending Directors have to obtain DIN within the prescribed time frame as notified.

(6) Can a director be appointed without DIN?

If you want to be appointed as director of an existing company, it is mandatory that you get your DIN prior to your appointment as a director.

(7) The validity period of the director identification number is how many years?

DIN has lifetime validity. However, a director has to complete his DIR-KYC every financial year to keep his DIN active.

(8)Who can apply for Director Identification Number (DIN)?

Any person desiring to become a director of an existing company or a new company can apply for DIN.

(9)How much time does it take to get Director Identification Number or DIN?

The government allocates DIN within 3 working days.

(10)Is there any fees to be paid along with DIN application?

Yes, you must pay Rs 500 as DIN application fee.

(11)Is income tax PAN mandatory while applying for DIN?

Yes, PAN is mandatory while applying for DIN for Indian nationals. However, PAN is optional for foreign nationals.

(12)Is DIN to be renewed every year?

Every Din holder must complete his DIR 3 KYC before 30th April of the immediate next financial year to renew his DIN. This is to be done every financial year annually.

(13)What if DIN KYC is not done?

MCA will deactivate the DIN of the director if he does not file the e-form DIR-3 KYC within the prescribed time.

(14) Can Provisional DIN be used for e-filing?

No, you cannot use your provisional DIN to either file an e-form or sign as a director.

(15) Can a director have two DIN?

A director will have only 1 DIN regardless of the fact that he is a director in more than one company.

(16)What is the Director KYC Due date for FY 2022-23?

Director KYC Due Date for FY 2022-23 is 30th September 2023.

(17)How to check DIN number by name?

You can check DIN number of the Director and other details such as Full name, Designation, Whether DSC registered, Expiry date of DSC, and Surrendered DIN by navigating the MCA portal>MCA Sevices> Master Data>View Signatory Details.

(18) Does DIN expire?

Once a permanent DIN is allotted, the DIN has lifetime validity.

(19) What is the DIR-3 KYC Due date for FY 2022-23?

DIR-3 KYC Due date for FY 2022-23 is 30th September 2023.

(20)What is the DIR-3 KYC Due date for FY 2022-23?

Eform DIR-3 KYC Due date for FY 2022-23 is 30th September 2023.

(21)How do I surrender DIN?

A director may surrender his DIN by submitting the e-form DIR-5 at the MCA portal.

(22)How to find din number by name?

Navigate from Home>MCA Services> Master Data> View Signatory Details. Here, enter the company name and hit on Search. You will get the DIN number by name in this manner.

(23) Can I do a DIN Number Search by name of the Director?

Yes, you can do a DIN Number Search by name by navigating to MCA Services>Master Data>View Directors Master Data.

How to deactivate din