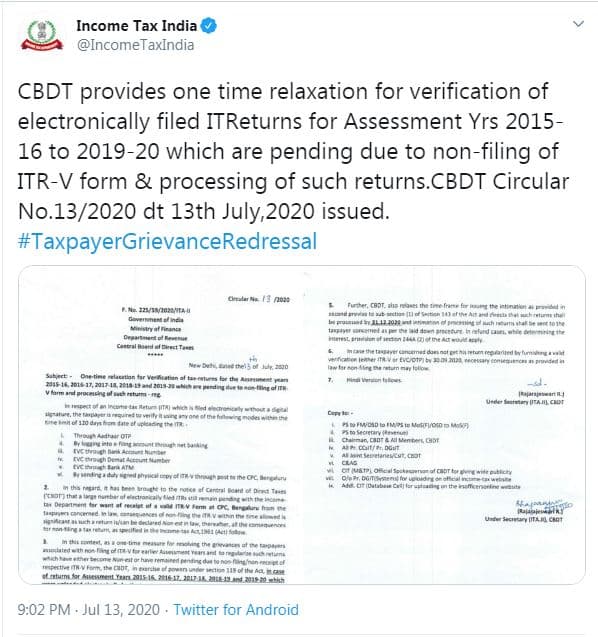

CBDT provides one-time relaxation for electronically filed ITR V verification. It is applicable for the IT Returns filed for Assessment Yrs 2015-16 to 2019-20, which are pending due to non-filing of ITR-V form & processing of such returns. CBDT issues Circular No.13/2020 on 13th July 2020 in this regard.

Excerpt of the Income Tax India Twitter Post

Pending For ITR-V Verification

It means electronically filing ITR V. However; the taxpayer has not verified the tax return. Income Tax Return is valid only if a taxpayer completes the verification on the IT Return. And taxpayer must do the e-verification process within the specified time limit from the date of uploading the ITR. There are different options available to the taxpayer to e-verify the tax return.

ITR V Form Verification Options

In respect of an Income-tax Return (ITR) filed electronically without a digital signature, the taxpayer must verify it using any one of the following modes within the time limit of 120 days from the date of uploading the ITR: –

i. Through Aadhaar OTP

ii. By logging into an e-filing account through net banking

iii. EVC through Bank Account Number

iv. EVC through Demat Account Number

v. EVC through Bank ATM

vi. By sending a duly signed physical copy of ITR-V through the post to the CPC, Bengaluru

Consequences of Non-filing ITR V

In this regard, the Central Board of Direct Taxes (‘CBDT’) observes that a large number of electronically filed ITRs remain pending with the Income Tax Department for want of receipt of a valid ITR-V Form at CPC Bengaluru from the taxpayers. In law, the consequences of non-filing the ITR-V within the time allowed is significant. First, the IT department can declare a return as Non-est in law. After that, all the implications for non-filing a tax return, as specified in the Income-tax Act,1961 (Act), follow.

ITR V Verification One Time Relaxation

3. In this context, as a one-time measure for resolving the grievances of the taxpayers associated with non-filing of ITR-V for earlier Assessment Years and to regularise such returns which have either become Non-est or have remained pending due to non-filing/non-receipt of respective ITR-V Form, the CBDT, in the exercise of powers under section 119 of the Act, in case of returns for Assessment Years 201S-16, 2016-17, 2017-18, 2018-19 and 2019-20 which were uploaded electronically by the taxpayer within the time allowed under section 139 of the Act and which have remained incomplete due to non-submission of ITR-V Form for verification, now permits verification of such returns either by sending a duly signed physical copy of ITR-V to CPC, Bengaluru through speed post or through EVC/OTP modes as listed in para 1 above. The taxpayer must complete such a verification process by 30.09.2020.

Taxpayer to whom the relaxation is not applicable

4. However, this relaxation shall not apply in those cases, where during the intervening period, the Income-tax Department has already taken recourse to any other measure as specified in the Act for ensuring the filing of a tax return by the taxpayer concerned after declaring the return as Non-est.

5. Further, CBDT also relaxes the time frame for issuing the intimation as provided in the second provision to sub-section (1) of Section 143 of the Act and directs that such returns shall be processed by 31.12.2020 and intimation of processing of such returns shall be sent to the taxpayer concerned as per the laid down procedure. In refund cases, while determining the interest, provision of section 244A (2) of the Act would apply.

Last Date to e verify ITR V

The taxpayer must complete the ITR verification process by 28th Feb 2022. Beyond this date, necessary consequences as provided in law for non-filing the return may follow.